.jpg)

P11D forms are important for letting HMRC, employees, and employers see the value of the benefit received and the tax implications of this. There are different rules for the various types of benefits, and it is important to treat each benefit correctly, to avoid under or overpaying Class 1a National Insurance Contributions (NICs). Learn the essentials to completing your P11D forms with our guide.

What is a P11D form?

A P11D is a form used to report any benefits that have been provided by employers to their employees. HMRC require that all P11D and P11D(b) submissions must be made electronically. HMRC no longer accepts paper P11D form submissions.

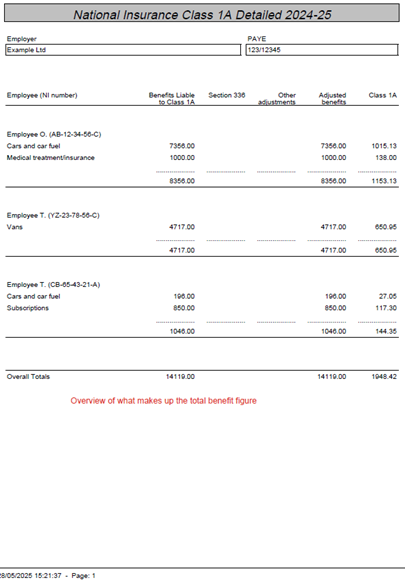

P11D forms are specific to each employee based on the benefits an employer provides them. They should each receive a copy of their own form. The P11D(b) form summarises the benefits provided by the employer and an overview of how much Class 1a NIC is due.

Once HMRC receives the forms P11D, an adjustment will be made to the employee’s code number so that PAYE will be collected on the benefit in kind in future years. A separate tax calculation may be issued if tax is outstanding for the year of submission.

What info does the form require?

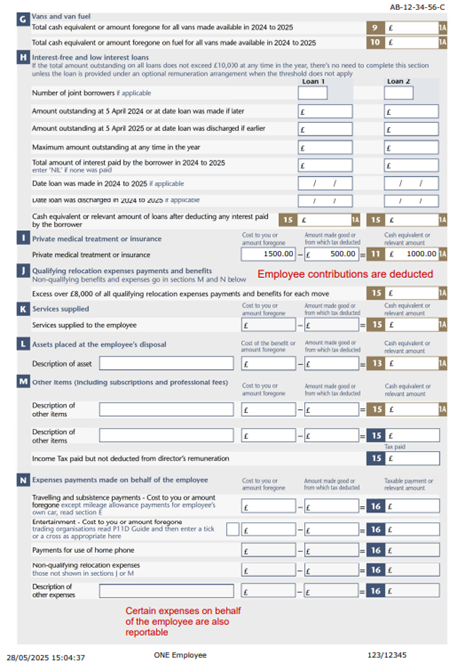

On P11D forms, you must report all the relevant benefits provided to all employees. This includes the value of the benefit in question and any other details needed to work out the benefit amount.

For example, the benefit value for cars requires additional information including:

- the list price,

- the value of any additions,

- CO2 emissions and

- engine capacity.

Most other benefits simply need the cost to the employer of providing the benefit.

The details of any contributions made by the employee towards the benefit will also need to be reported so that tax and National Insurance aren’t charged on the full amount.

Certain benefits are exempt from P11D. For example, a mobile phone or gift voucher below £50 you provide an employee does not need reporting within the P11D submission.

How to complete a P11D form

-

First, determine whether a P11D form is required. If the benefits are reported via your payroll scheme, then a P11D form is not required. However, a P11D(b) form will still be required, to report and pay any Class 1A NICs that may be due.

-

If a P11D form is required, you must provide the details of all benefits you provide your employees. This can be done by using either HMRC’s software or third-party software.

-

Employers can fill out the relevant boxes and information based on the benefits that have been provided. A separate P11D form is needed for each employee – yes, really.

-

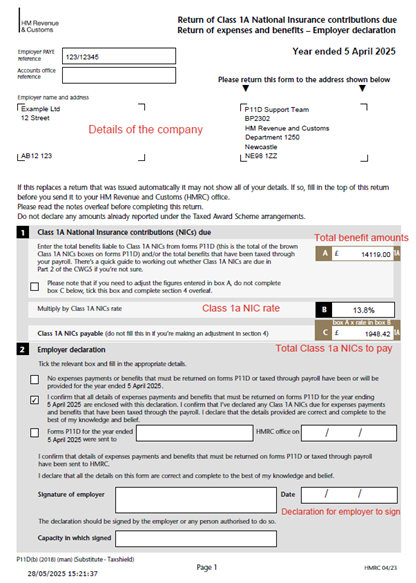

You must then complete a P11D(b) form. The P11D(b) form is used to declare the total amount of Class 1A NIC that is due.

-

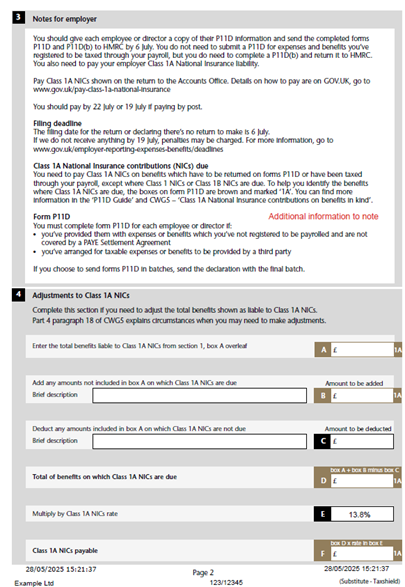

To calculate the amount of Class 1A NICs, total all the taxable benefits from the P11D form(s) and apply the NIC relevant percentage (13.8% for 24/25).

-

After completing both the P11D and P11D(b), you can then file and submit both forms with HMRC. These forms must be submitted by the 6 July deadline following the end of the tax year (6 July 2025 for the 2024/25 tax year).

Tips for completing a P11D form – mistakes to avoid

- Mixing up the treatment of different benefits – Benefits such as cars and vans have special rules that are easy to mix up. It is important to get the right treatment for each benefit so the correct tax and Class 1a NICs are paid.

- Not recognising exempt benefits – Some benefits are not liable to Class 1a NICs and do not need to be reported. These include a mobile phone, business travel, relevant professional subscriptions and uniforms. Always check which benefits are reportable and which are exempt.

- Not being aware of benefits with conditions – Certain benefits have conditions for whether they are reportable or not. For example, Director’s Loan Accounts and staff entertainment must be over a certain value to be a reportable benefit.

- Forgetting to include payrolled benefits – If there is a mixture of payrolled and non-payrolled benefits, it is important not to forget to include the payrolled benefits on the P11D(b) form. All the benefits that are subject to Class 1a NICs must be reported.

- Forgetting to include employee reimbursements – Contributions made by employees towards their benefits should be reported and will reduce the taxable benefit.

P11D form example

After you filed your P11D forms…

Once the P11D and P11D(b) forms have been submitted, each employee must be given a copy of their own P11D form. The Class 1a NICs must also be paid to HMRC by 19 July after the end of the tax year (or 22 July if paid electronically). It is good practice to keep these documents for six years from the end of the tax year they relate to.

P11D vs P11D(b): What’s the difference?

If an employer provides benefits through their payroll, they only need to submit a P11D(b). If benefits are provided and are not put through the payroll, P11Ds are needed for each employee and a P11D(b) is needed to summarise the Class 1a NICs due. The differences between the two forms are detailed below:

| P11D | P11D(b) |

| One needed per employee | Only one needed each year |

| Only needed if benefits are not payrolled | Required if any benefits are provided – including payrolled benefits |

| Shows a breakdown of the benefits and how they have been calculated | Is a summary of all the benefits provided to employees |

| Shows the value of the benefit provided | Shows the amount of Class 1a NICs due |

Get help with your P11D forms

If you would like assistance with the reporting of your benefits in kind, the Tax Compliance Team at Shorts would be happy to help. Whether you are a large or small business, Shorts can help ease the pain of processing a P11D by working out any calculations needed to find the assessable value of benefits or processing large numbers of P11D forms efficiently.

We can help ensure there are no errors or inconsistencies within the P11D forms, and advise you regarding payment of any Class 1A liability arising and meeting HMRC’s deadlines.

Mia Bambridge

I work as a Junior tax Adviser as part of Shorts's Tax Compliancy team.

View my articlesTags: tax compliancy, P11D, P11D(b)