Basis Period Reform takes effect from the tax year 2024/25 and aims to create a simpler set of rules for the allocation of trading income to tax years.

Table of contents

| Background for Basis Period Reform | Jump to section |

| What is the Basis Period Reform and why is it happening? | Jump to section |

| Who will be affected by Basis Period Reform? | Jump to section |

| When will Business Period Reform take effect? | Jump to section |

| What about higher profit businesses? | Jump to section |

| How does Basis Period Reform link to other types of income? | Jump to section |

| Will the transitional profits affect other income tax charges and reliefs? | Jump to section |

| What happens if I make a loss in the transitional year? | Jump to section |

Background for Basis Period Reform

Unincorporated trading businesses usually prepare annual accounts to the same date each year, which is known as their ‘accounting date’. A business’ profit or loss for a tax year is usually the 12-month period ending on the accounting date within the tax year, which is known as the ‘basis period’.

For example, a sole trader with a 12-month accounting date ending on 30 April 2023 will be taxed on that income in the tax year 2023/24.

Specific rules determine the basis period in certain cases, including during the early years of trading. These rules can create overlapping basis periods, which charge tax on profits twice and generate corresponding ‘overlap relief’ which is usually given on cessation of the business or a change of accounting date. Overall, this basis of taxation is called the ‘current year basis’.

What is the Basis Period Reform and why is it happening?

The basis period reform will see a transition from the current year basis to a tax year basis. This means the profit or loss of a business will be calculated for the tax year rather than to the accounting date ending in that tax year.

The rules which currently require apportionment of profits to basis periods will instead require apportionment of profits to tax years.

The commencement, cessation and changes of accounting dates will no longer require the complex opening year and cessation rules, as the relevant periods will align with the tax year.

This change will eliminate overlap profits and the need for overlap relief in the years after the changes. The reform will provide for the use of existing accrued overlap relief.

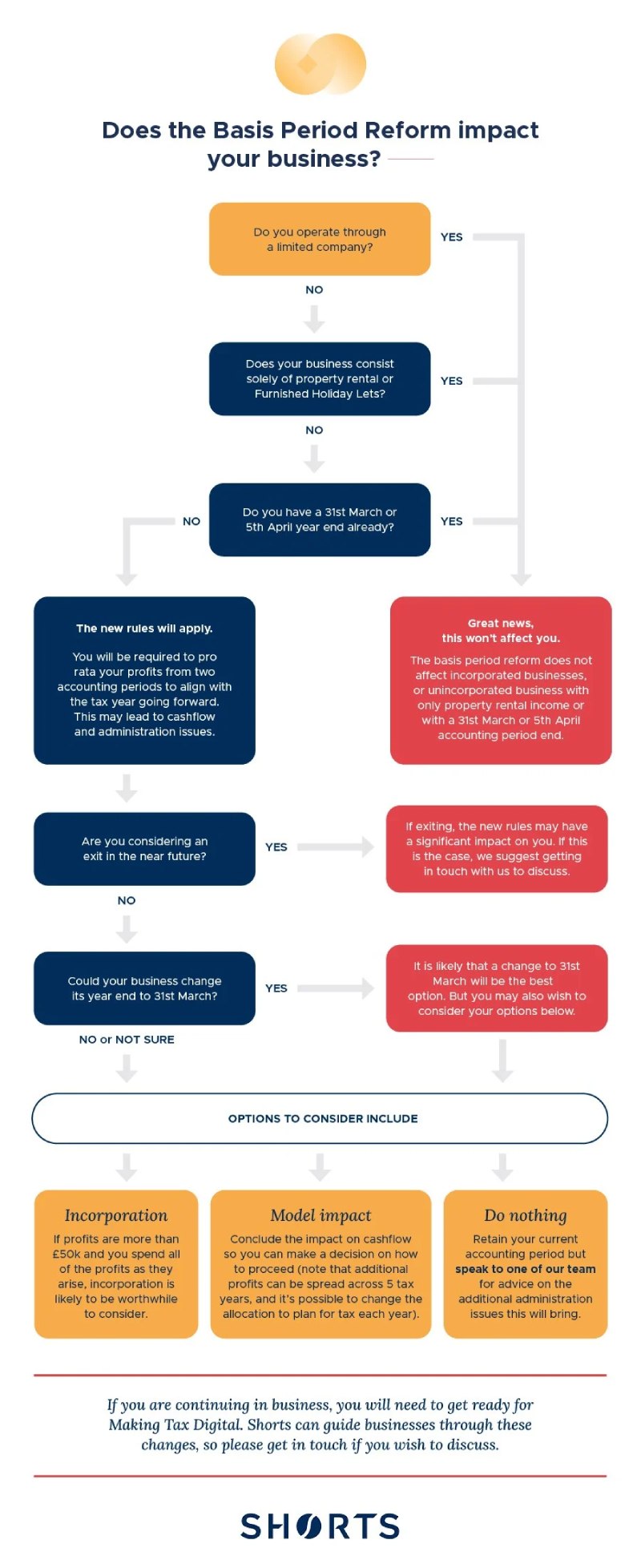

Who will be affected by Basis Period Reform?

The basis period reform will affect a number of business types:

- sole traders

- partners in trading partnerships including LLPs

- other unincorporated entities with trading income such as trading trusts and estates

- non-resident companies with trading income charged to Income Tax.

This measure will only affect businesses with an accounting date which does not align with the tax year (i.e., not with a year end of 31 March or 5 April), and these businesses will be required to apportion profits to adjust their taxable results to the tax year basis.

There are an estimated 528,000 sole traders and partners with non-tax year basis periods.

ExampleA business with an accounting date of 30 April will be required to apportion one month (i.e., one twelfth) of the results for that period and apportion eleven months (i.e., eleven twelfths) of the results of the following accounting period to assess the twelve months in the tax year from 6 April to 5 April. This could create a problem where the results for the following accounting period are not yet available and would therefore require estimated figures which would need amending once the results have been finalised. There will be equivalence rules for businesses with accounting dates between 31 March to 5 April to prevent these businesses' having to apportion small amounts of profit. |

When will Business Period Reform take effect?

The Basis Period Reform will take effect from the tax year 2024/25, with a transitional year for the 2023/24 tax year. On transition to the tax year basis in the tax year 2023/24, all business’ basis periods will be aligned to the tax year and all outstanding overlap relief given.

The basis period for the transitional year of 2023/24 will be the 12-month accounting period ending between 6 April 2023 and 5 April 2024, plus a transition component running from the end of this 12 months to 5 April 2024 (or 31 March 2024). Any overlap profits brought forward and/or generated will be relieved in full in 2023/24 and not carried forward into the tax year basis.

ExampleA business with an accounting date of 30 April will need to include the following results to determine the taxable profits for the transitional tax year 2023/24:

As you will see, this transition could result in a significantly accelerated and increased tax bill. |

What about higher profit businesses?

For businesses with higher profits in 2023/24, due to the change in basis, there will be an automatic election to spread the additional profits of the transitional period over the following five years. There will be an option to allow a business to elect out of spreading and accelerate the charge, to treat additional amounts as arising in the tax year.

How does Basis Period Reform link to other types of income?

All other forms of income are taxed on a tax year basis for individuals, including property income, interest, and dividends. This policy aligns trading income with these other forms of income and links in with the governments' plans for MTD for ITSA.

Will the transitional profits affect other income tax charges and reliefs?

The transitional profit will create a standalone tax charge which will not affect the level of taxpayer’s income that is used to calculate entitlements to relief on pension contributions and Child Benefit. It could, however, lead to tapering of an individual’s tax-free personal allowance where total taxable income is in excess of £100k

What happens if I make a loss in the transitional year?

In the event of a loss, the taxpayer will be able to treat the business as ceasing on 5 April 2024 and claim terminal loss relief to carry back against the three preceding tax years.

How can we help?Basis Period Reform presents a number of complexities for businesses, and you may have concerns or queries about how it might affect you and your business. If this is the case, our dedicated tax and accounts teams are happy to offer expert advice that is tailored to your position. If you think this might help, we encourage you to get in touch and book a consultation – the earlier the better! |

Steven Strawther

I deal with all aspects of personal tax compliance and since joining Shorts I have gained valuable experience in private client advisory and planning opportunities. I have been instrumental in refining the personal tax compliance process and implementing digital solutions to provide clients with an efficient personal tax service.

View my articles