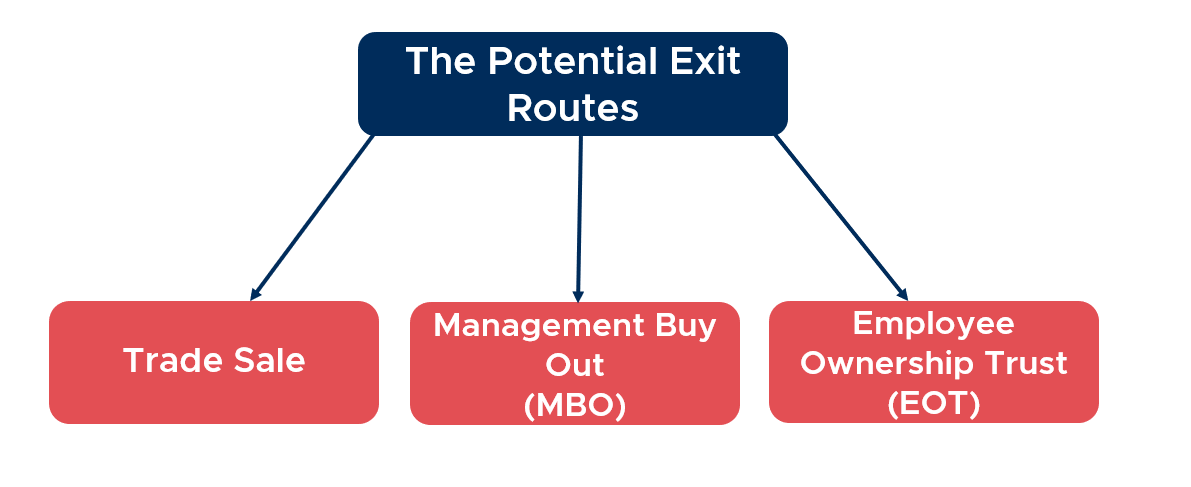

Planning the best route to exit your business can begin many years before any transaction takes place. There are several ways to exit a business, each with their own set of benefits and possible pitfalls.

Here we will look at three of the most popular exit strategies, and help you understand which might be most suitable for you and your business.

How much is your business worth?

For business owners, the current value of your business is vital information, particularly in helping you decide if it is time to consider your exit planning options. You can use our free Business Valuation Calculator today to gain a rough idea of what your business may be worth.

What is the best exit for me?

The following was covered in a recent seminar organised by Shorts, along with NatWest and Freeths.

You can watch the full segment below, which explains what each strategy is, and the unique benefits of each.

Types of exit strategies for business owners

- Trade Sale: The sale of a business to another company, which could, for example, be a competitor, customer, or investor.

- Management Buyout: The sale of a business to its own senior management team.

- Employee Ownership Trust: The sale of a business to a trust for the benefit of all employees, not just the senior management team.

What is a Trade Sale?

The Trade Sale process is very well established. A Trade Sale sees a company sold to another business, often one that operates in the same industry, such as a competitor. The sale may be an outright acquisition of the business, or it may involve an asset sale (such as business premises or plant and machinery).

A Trade Sale will often be the option e that has the potential to achieve the highest sale value for the seller.

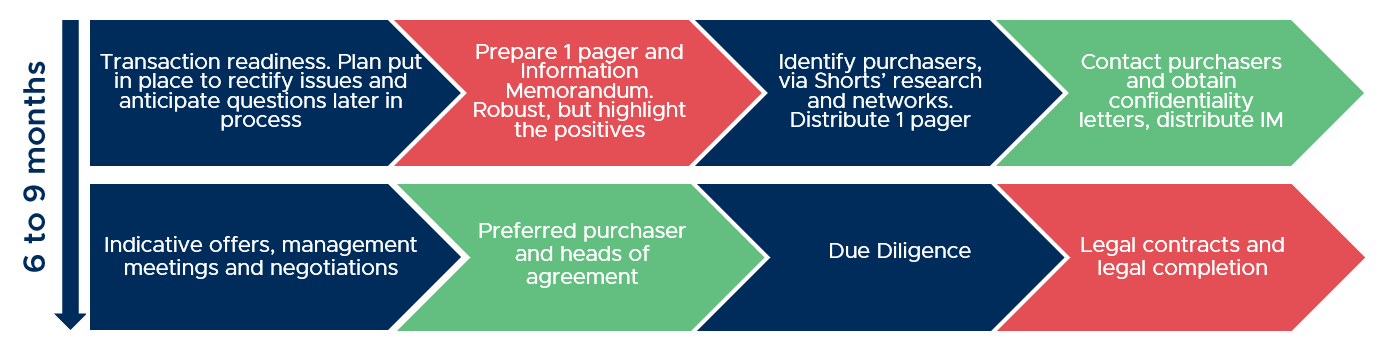

How long does the Trade Sale process take?

This process generally takes between 6-9 months but can vary. The objective of this process is to ensure you are as well prepared as possible as a seller, can avoid any surprises, and that you time your sale well.

It also ensures all seriously interested parties are in a process that is under the control of you and your advisers, with confidentiality maintained. This also helps you ensure all potential acquirers have the same robust information, which makes decision making and process much easier for the seller.

The process will also drive competitive tension, which helps maximise price, avoids price chips and ultimately helps you get the deal done.

Pros and Cons of a Trade Sale

| Pros of a Trade Sale | Cons of a Trade Sale |

| Maximise transaction value (if strategic buyer is identified) | You will potentially need to release information to competitors |

| Clean exit | Confidentiality |

| An appropriate buyer can take the business to the next level | You will lose control of your business once the transaction completes |

| Presents opportunities in a larger organisation for senior management and employees | It can be difficult finding the right buyer |

| It can create longer term uncertainties relating to your legacy and employees |

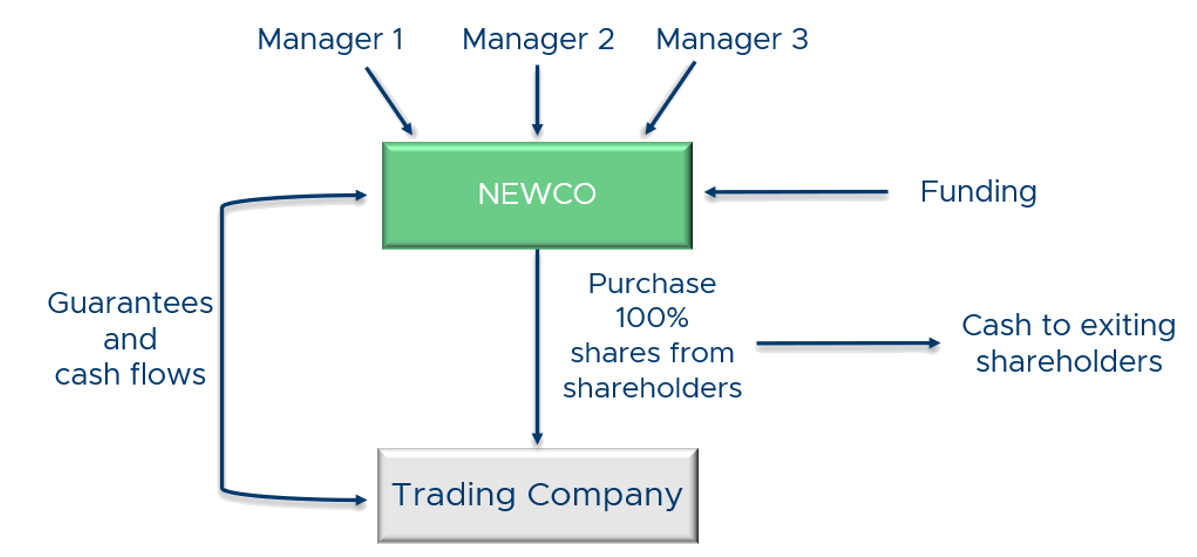

What is a Management Buyout (MBO)?

A Management Buyout (MBO) is a sale in which the management team acquires a controlling stake of the company, purchasing it from the parent company or a private owner.

How is a Management Buyout funded?

Usually, the first question that is asked regarding an MBO is how the management team are going to afford the transaction. They will not usually have the funds to hand required for the transaction.

What the Management Team usually do is offer a contribution, such as 1-times their yearly salary, plus rolling forward the value of any shares they may already own. This gets invested into NewCo, which is the shell company set up by the management team who plan to go ahead with the MBO.

From here, NewCo will seek additional funding from a bank or other lender. There will often also be some deferred consideration required from the sellers (payments representing a proportion of the initial sale proceeds, paid after the sale completes over a period of time), which helps support the transaction.

Pros and Cons of a Management Buyout

| Pros of a Management Buyout | Cons of a Management Buyout |

| It presents a significant opportunity for senior management | It is dependent on raising funds |

| There is no need to market the business for sale | Owner is likely to have to support the transaction through deferred consideration |

| Generally, you will receive full market value for shares, subject to negotiation | The business takes on debt |

| Certainty of exit | Price is certain but could be lower than the price offered by a strategic trade buyer |

| You can preserve the legacy of the business | |

| If backed by Private Equity, it can bring investment |

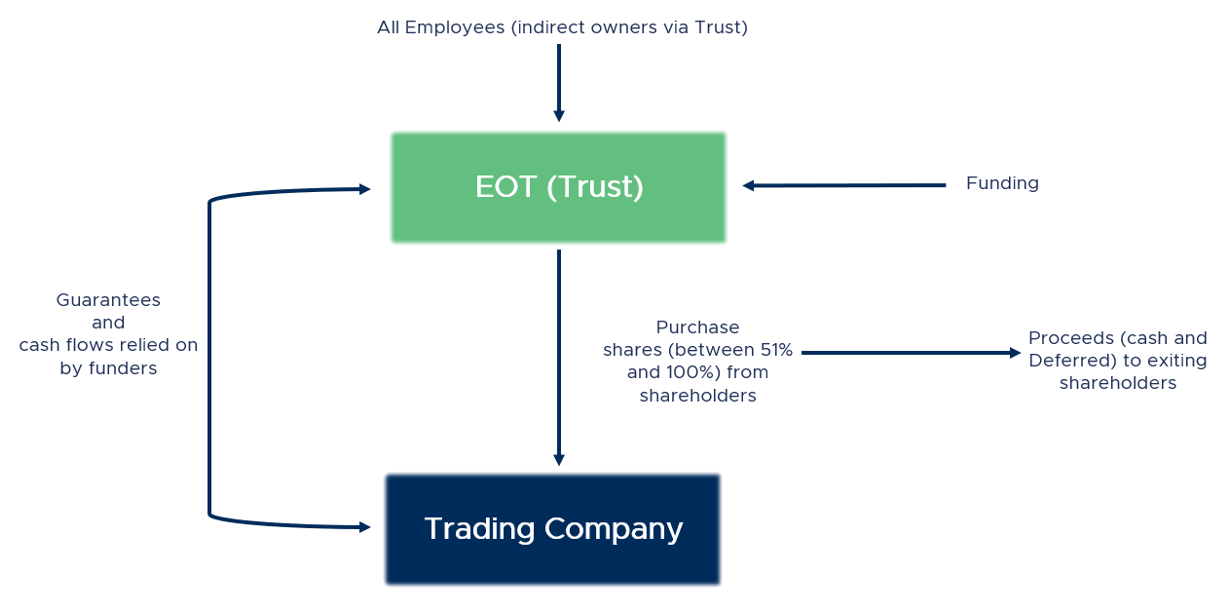

What is an Employee Ownership Trust (EOT)?

While Employee Ownership Trusts are becoming increasingly popular since their introduction in 2014, they are still relatively less well known than an MBO or Trade Sale.

An EOT process is similar in structure, in some ways, to the Management Buyout. The biggest differences are that none of the employees have to make any contributions to the trust, and the trust is set up for the benefit of all employees.

The trust purchases a minimum of 51% of the shares from the existing shareholders and pays through cash available at completion and, usually, a large element of deferred consideration.

Pros and Cons of an Employee Ownership Trust

| Pros of an EOT | Cons of an EOT |

| Receive full market value for shares | An element of deferred consideration is required |

| Certainty of exit | Price is certain but could be lower than that offered by a strategic trade buyer |

| Zero capital gains tax on business sale | |

| Succession can be implemented over a period and previous owners can retain a level of involvement | |

| You can preserve the legacy of the business | |

| Tax free bonuses of up to £3,600 for employees | |

| Appeals to altruistic owners and rewards the loyalty of employees who have helped the business succeed |

You can learn more about the full pros and cons of an Employee Ownership Trust in our blog.

How to make an exit strategy decision

When it comes to making a decision on which exit strategy is best for you, we recommend considering the following 5 areas.

- Valuation/Price: Achieving the maximum value for your business

- Legacy: What is the ethos of the company going to be after the sale? What is going to happen to the company brand and customers?

- Deal Structure: When is the money going to be paid, what is the risk of not being paid and how will this affect your short- and long-term plans.

- Timeframe & Certainty: When is the transaction going to happen and how certain can you be of this?

- Employees: What is going to happen to the employees who have helped your company be successful?

Early exit planning is essential to ensure you get the very best deal for both yourself as an exiting shareholder, and it achieves the future you want for your business. If you are unsure about which exit strategy is best suited to you, we strongly recommend consulting our Corporate Finance team for advice.

Tags: Corporate Finance, EOT