The VAT Capital Goods Scheme (CGS) in the UK is a scheme that applies to high-value property transactions (currently property exceeding £250,000). In the Spring 2025 Tax Update, the government announced plans to simplify the Capital Goods Scheme including increasing the threshold for land, buildings and civil engineering works to £600,000.

It's important to note that even if all the VAT is initially reclaimed on a property purchase, an adjustment might be required at a later date if the use of the property changes. Any potential change should be considered when undertaking property transactions.

The primary purpose of the CGS is to ensure that the amount of VAT reclaimed accurately reflects the use of the property for taxable activities over a longer timeframe. This is an essential factor to consider in high-value property transactions.

Capital Goods Scheme, explained

- The Capital Goods Scheme applies to acquisitions, construction or renovations of land/property where the value exceeds (£250,000 excl. VAT)

- The monitoring period is usually 10 years, starting when the property is first occupied/used.

- If the property is used entirely for taxable activities, adjustments will not be needed. However, if used for a mix of taxable and non-taxable activities, additional VAT may need to be repaid or reclaimed based on how these activities are proportioned.

What does a “change in use” actually mean?

Change of use means to what extent the property is used for taxable (VATable) transactions. A shop, for example, may exclusively be used for taxable transactions and will, therefore, be unlikely to need a Capital Goods Scheme adjustment.

Capital Goods Scheme example: converted warehouse

A company acquires a warehouse for £300,000 (excl. VAT) and renovates/converts it into a restaurant and events space (taxable activity).

The purchase price exceeds £250,000, so the Capital Goods Scheme will apply. The company recovers all of the VAT at the time of purchase because the initial planned use of the property is taxable.

No change of use

If the company converts the warehouse and solely operates as a restaurant and event space for the 10-year CGS period, no adjustments are needed because the property’s use aligns with the initial VAT reclamation.

Change of use to include non-taxable activities

If the same company decided to rent out a portion of that space for office use part way through the 10-year CGS period, they would be introducing a mixed property use (as office rentals are not automatically VAT-rated). They would need to repay a portion of the originally recovered VAT, depending on the percentage of the property used for the office space (non-taxable use).

If the property is sold

If the company decides to sell the converted warehouse within the 10-year CGS period, a one-time adjustment (crystallisation) of the CGS scheme would be triggered based on the VAT treatment of the sale.

If the sale is VAT-exempt, the company could potentially have to repay a significant portion of the initial VAT they recovered because the sale itself is not taxable (unless there is an option to tax in place).

Why does the Capital Goods Scheme cause problems for businesses?

VAT is seldom straightforward, and it’s easy for businesses with multiple income streams to get caught out by specific rules that may not be evident initially.

The Capital Goods Scheme was introduced in the 1980s when significantly fewer properties exceeded the £250,000 threshold. Nowadays, with property prices rising all the time but the threshold remaining static, many more businesses are being affected by the CGS. Although, the change in the threshold to which the Capital Goods Scheme applies has been announced, no date for the implementation of the change has been confirmed.

Here are a few ways the Capital Goods Scheme can make life tricky for businesses that aren’t fully aware of their obligations:

Unexpected clawbacks

If a company buys a new building and reclaims the VAT but sells it later, they may find themselves with a surprise VAT bill (plus potential interest or penalties) several years later that they did not factor into their cash flow.

Business structure changes

A lot can happen in 10 years. Specific CGS rules relate to one-off events, such as business mergers or leaving a VAT group. Failure to consider these rules can lead to complications.

Complex record keeping

As previously mentioned, an extensive 10-year monitoring period is associated with the CGS, including ongoing adjustments to the initial VAT reclaimed over time. This can complicate bookkeeping, with a risk of errors or difficulties in locating information to carry out the calculation.

Avoid getting caught out

Many UK businesses are being caught up in unexpected issues relating to the Capital Goods Scheme, negatively affecting their cash flow, creating new administrative burdens, and often resulting in penalties.

If your company has purchased a property over £250,000 in value or carried out renovations costing more than £250,000, on which you reclaimed VAT, it is crucial that you have your VAT situation evaluated to make sure you do not get tripped up by this often confusing VAT requirement.

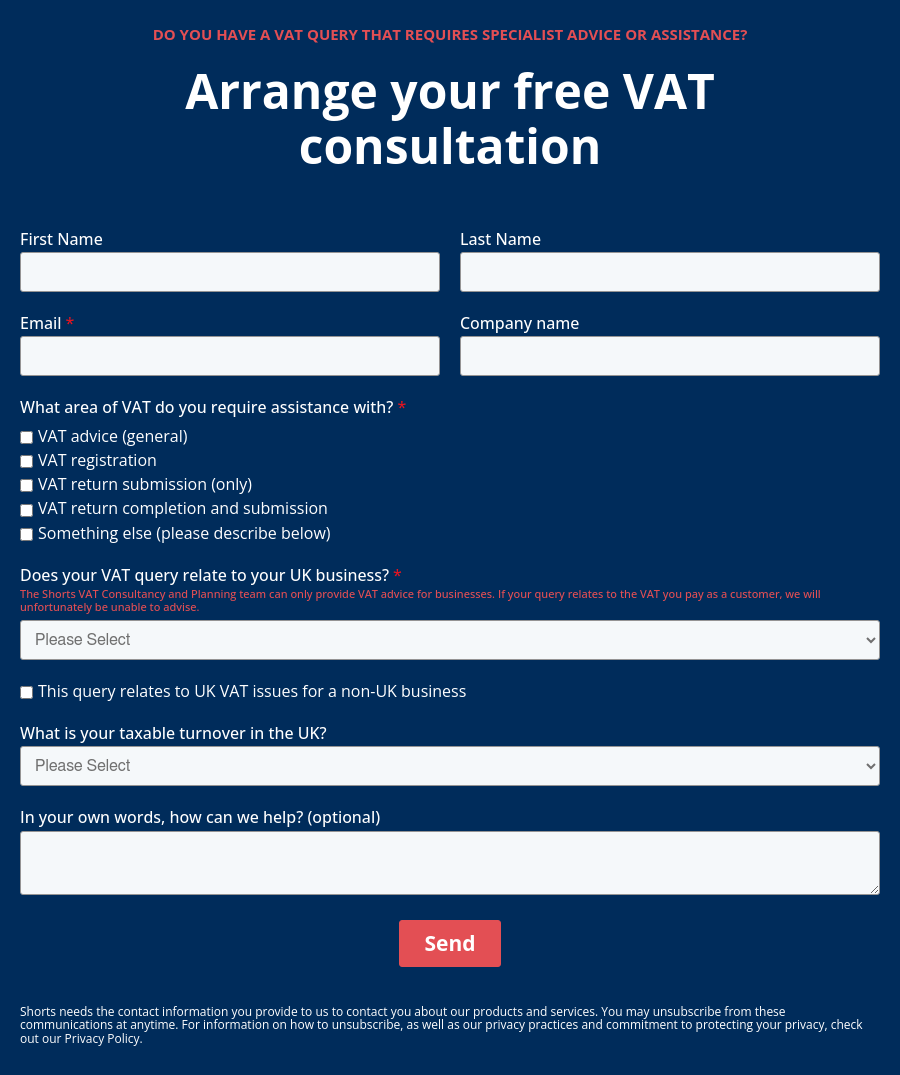

As always, our dedicated VAT team is happy to offer qualified advice on these issues if required. We encourage you to contact us using the form below if assistance is needed.

Lynne Gill

My area of expertise is land and property transactions but I have extensive knowledge of both domestic and international VAT and I love complex VAT queries. I have an Honours degree in Business Studies and a VAT legal and technical qualification from the Institute of Indirect Taxation.

View my articlesTags: VAT