2021 saw global Mergers and Acquisitions (M&A) activity reach a new height of dealmaking, with total deal values amounting to a whopping $5.9 trillion.

The early signs suggest that 2022 could be another record year for M&A as deal multiples begin to rise.

Current Market Conditions

The number of deals completed in the UK in 2021 rose by 42% compared to 2020 alone.

Not only that, but number of deals also exceeded the levels seen pre-pandemic in 2018 and 2019 by 8% and 21% respectively.

For years, the average multiple for your typical SME ranged somewhere between 3x and 5x normalised profits – we are now seeing this figure beginning to rise.

Dealsuite – the largest and most active community of dealmakers in Europe – has seen the average profit multiple for UK and Ireland SMEs rise to 5.45x.

| Average EBITDA Multiple per Sector | H1, 2021 | H2, 2022 | Change |

| Healthcare & Pharmaceuticals | 8.40 | 8.50 | 0.10 |

| IT Services & Software Development | 8.65 | 8.20 | (0.45) |

| E-Commerce & Webshops | 7.50 | 7.40 | (0.10) |

| Agri & Food | 5.30 | 6.00 | 0.70 |

| Business Services | 5.90 | 5.50 | (0.40) |

| Industrial & Manufacturing | 4.50 | 5.30 | 0.80 |

| Media & Communications | 5.65 | 4.60 | (1.05) |

| Hospitality & Tourism | 3.65 | 4.50 | 0.85 |

| Retail Trade | 4.10 | 4.30 | 0.20 |

| Wholesale Trade | 3.70 | 3.80 | 0.10 |

| Automotive, Transportation & Logistics | 4.65 | 3.70 | (0.95) |

| Construction & Engineering | 3.65 | 3.70 | 0.05 |

Source: Dealsuite "M&A Monitor UK&I H2 2021"

Dealsuite is typically used to buy and sell businesses with a valuation below £10 million (Making up 78% of businesses sold on the platform in H2 2021) – giving a good reflection of the demand for SME businesses currently.

Strong, continued demand for IT Services, SaaS and Healthcare businesses has assisted in the overall improvement of multiples in recent years, with these sectors seeing average multiples of over 8x normalised profits.

Whilst some sectors such as Hospitality and Tourism understandably struggled during the pandemic; these have rebounded strongly in H2 2022 as investors seek to invest in these sectors now restrictions have eased.

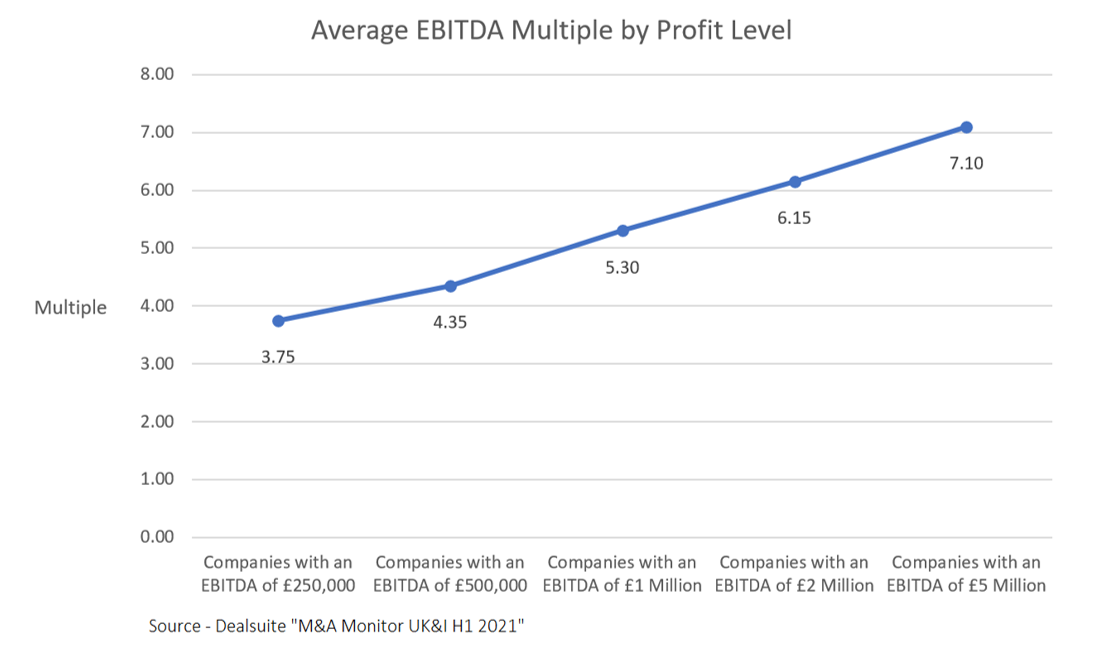

Another notable feature is that multiples are currently varying significant depending on the overall profitability of the business as acquirers look to buy more “robust” businesses in the current economic climate.

There is a significant gap between the multiples for a business making lower profits than those with higher profitability.

Interested to find out the value of your business in the current market conditions? Please get in touch with a member of our team.

Why is this happening?

Whilst much of the demand in the market is due to the pent-up demand caused by Covid-19, the rise of the Employee Ownership Trust (EOT) has also changed the landscape of M&A in the UK – many potential sale mandates, MBOs and MBIs are now becoming EOTs due to the benefits they could provide.

To learn more about these benefits, please see our page on Employee Ownership Trusts.

This fall in sale mandates has meant that companies and potential acquirers are now having to offer higher multiples in order to put forward a compelling offer which gives shareholders an improved position than an EOT potentially could.

Additionally, many Private Equity firms are still playing catch-up to some extent for the lack of activity in 2020 and are becoming more aggressive with their offers and deal structure in order to try and compete with trade buyers and invest the significant funds they have available.

UK Private Equity firms completed 1,545 deals in 2021 – a significant increase from 1,117 in 2020 and 1,246 in 2019.

Finally, 2021 saw more corporate entities enter into M&A as they looked to strengthen and enhance their businesses further as a result of the potential weaknesses exposed in the Covid-19 pandemic – With M&A allowing these businesses to potentially address structural or commercial issues highlighted by the pandemic rapidly whilst also improving market share and overall robustness.

All of these factors have culminated in a highly competitive market with sale mandates now receiving numerous competitive offers from both Trade Buyers and Private Equity firms regularly.

Our Experience

At Shorts, we have seen average multiples in the last 12 months routinely rise to between 4x and 6x normalised profits for most businesses, with some businesses going up to 10x normalised profits.

Not only have we seen the multiples for SMEs increase but also the demand from larger acquirers for these businesses.

This past year we have been in regular contact with a number of large plcs and £100+ million turnover businesses regarding acquisition opportunities – with a lot of this contact coming from off-market approaches to our clients.

On top of this, we’re seeing record levels of interest in our recent sale mandates with some having more than 50 interested parties – unprecedented levels of demand for SME opportunities.

All in all, 2021 was a fantastic year for M&A and selling businesses – Early indications suggest that 2022 is going to continue this trend and be another fantastic year for exiting an SME business.

If you are a business owner considering your succession planning, why not contact our corporate finance team and explore your options?

Connor Marshall

I am a Corporate Finance Manager at Shorts, having joined the firm in 2021 as a Corporate Finance Executive. With a Master’s in Finance and Investment from Sheffield Hallam University, I have over six years’ experience working on a wide range of transactions, including MBOs/MBIs, EOTs, trade sales, fundraisings, and valuations, across sectors such as waste, recruitment, and engineering. Notable recent deals include Abbeydale Brewery’s sale to an EOT, Armeg’s sale to an EOT, and the MBO of Apex Consulting Engineers.

View my articlesTags: Corporate Finance