When it comes to managing accounts, payroll, and related business responsibilities, it is our belief that Xero offers the best, most flexible, and insightful platform for both small and larger businesses.

Why switch from Sage to Xero?

We think moving your accounts from Sage to Xero will be beneficial for your business for a number of reasons.

- Xero is a user-friendly platform, making training any new staff members a breeze.

- As it is a cloud-based platform, it can be accessed from anywhere with an internet connection, allowing for collaborative working on the accounts and makes year ends simpler by allowing you to share information with your accountants instantly.

- Xero also offers excellent time-saving features, such as linking your bank to automatically bring in your transactions (no more exports/imports!).

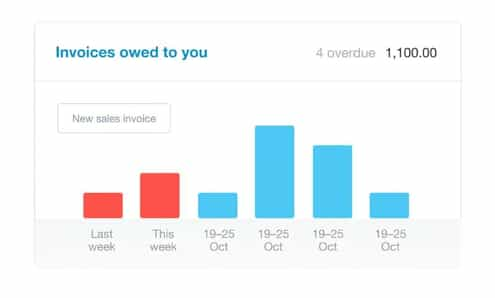

- Xero can automatically match your invoices to payments and receipts, speeding up the bank reconciliation process.

- You can send sales invoices directly from Xero, and track when they have been viewed.

- You can even scan purchase invoices directly into Xero so there is no need to hold onto paper copies.

- Xero has an enormous library of over 1000 useful add-ons to help you improve efficiency, get paid faster, improve reporting, grow your credit score, link various operations together, and much more.

What do I need to do before we move from Sage to Xero

The key to moving from Sage to Xero is planning.

Firstly, we recommend plenty of research. Consider what processes you currently have in the business. Will these still work in Xero? If not, can these be adapted?

We recommend mapping processes, as this will help you identify areas where efficiencies can be made through use of a particular function or add-on.

Next consider the time frame. You can move at any time, but our recommendation is to pick a year-end or VAT quarter end. This will allow you to work to a straight line for reporting purposes.

Tidying up your information on Sage

Before moving to Xero, it is important to tidy up the information you have in Sage. There are lots of ways this can be done, and we have listed some key steps below.

- IMPORTANT: Back up your Sage data.

- Make sure your customer and supplier details are correct; archive any old contacts that are no longer in use.

- Make sure the banks are all reconciled to the period end.

- Post any draft transactions.

- Make sure that your latest VAT return has been filed in Sage.

- Review your chart of accounts. Consider the current layout: is it fit for purpose, and does it align with your future plans?

- We recommend reducing the chart of accounts where possible to remove any nominals that are not in use, or which may cause confusion.

- Consider tracking categories in Xero. If you use “departments” in Sage, these can be brought through to Xero. You can also set them up when in Xero, allowing you to report on different departments, sectors, salespeople and more.

- Extract the invoice template you would like to use in Xero.

- Extract the fixed asset register from Sage (if applicable) – this cannot be moved automatically but can be done manually.

We recommend setting a timeline that includes tasks that must be completed; this helps you ensure all aspects of the project are considered and planned for appropriately.

How to move from Sage to Xero

Once your preparation work has been completed, you are ready to convert from Sage to Xero. The following instructions will outline the recommended steps to ensure a proper and thorough move across to the Xero platform.

- Create a new Xero account, completing the name and address fields, while making sure the year end date is correct.

- Create an account with a website called ‘MoveMyBooks’ - this picks up the individual transactions in Sage and brings them through to Xero.

- If you are looking to move your Sage Payroll organisation to Xero payroll, this unfortunately cannot be done through MoveMyBooks and must be transferred manually.

- Once you have created the account, select ‘New Conversion’ and follow the step-by-step instructions to convert the data.

- The conversion is free for the current financial year and prior year. For example, if your year-end date was 31 December 2021 and you were converting at the end of September 2022, the free conversion would extract transactions from 1 January 2021 to 30 September 2022.

- Additional years are available to be transferred (along with departments) for an additional fee.

- Once the conversion is running, grab a cuppa and wait for the email to come through to say it has been completed. Depending on the size and complexity of the organisation, this can be from an hour up to (usually) 24 hours.

- Most importantly – do not work on Sage after the backup has been taken. Any amendments or new transactions will not be posted into Xero.

I have received my confirmation email – can I start working in Xero straight away?

When you have moved from Sage to Xero and you have received your confirmation email, there are a few checks that we recommend making before jumping into Xero.

- Reconcile your bank transactions and make sure the bank reconciliation report matches your Sage report.

- Publish your last VAT return. Check in Sage to see if there are any late claims that need bringing across to the next VAT return, which will be done in Xero; if there are you will need to adjust for these manually in Xero.

- Compare the ‘aged debtor’ and ‘aged creditor’ reports between the two systems to ensure they match.

- Archive any unwanted contacts (for example, some may come through as ‘No Name’).

- Run a P&L (Profit & Loss) and Balance Sheet in both systems as a final check.

- Set lock dates for periods you don’t want to change, such as the year end.

Now you are ready to start using Xero!

How to get the most out of Xero’s functionality

Xero features a user-friendly interface and, as cloud-based software, is accessible any time and anywhere. Xero is the ideal software partner for any business that doesn’t always have the resources or time to dedicate to their accounts or learning how to maximise the potential of the platform. You can also use reporting add-ons to gain real time insights from your data in Xero. This will help make arduous reporting a thing of the past.

We suggest seeking some assistance when transferring a business from Sage (or any other platform) to Xero. At Shorts, our Genus team will work closely with you from the early planning stages, right on through to delivery and training, providing continuous support throughout and beyond the Xero project.

We have converted many organisations and are well placed to support you in your journey. Speak to us today for a free-consultation.

Our Xero qualifications

Shorts Chartered Accountants is one of the top 2% of Xero partners in the UK for clients and certified advisors. Our team was named “Advisory Team of the Year” at the Yorkshire Accountancy Awards and was described as a “standout example of a modern practice” in Xero’s “The Pacesetters.” We were also named Large Firm of the Year at the 2022 Xero Awards.

Alicia Williams

I am the Director of the Genus team at Shorts, a chartered certified accountant and Xero specialist. I specialise in cloud-based accounting solutions, particularly Xero and add-on software, helping clients streamline processes and improve efficiency. As a Client FD, I work closely with businesses to give them a clear understanding of their current position and support their long-term planning and growth.

View my articles