Whilst fears of a global recession and rising interest rates dominate economic news, the outlook for M&A (Mergers and acquisitions) activity across a wide range of sectors remains positive. It’s important to remember that there are several drivers of M&A activity, and these remain constant across all economic backdrops.

These drivers and influences “include buyers motivated by growth strategy, capital enabling the transactions and economic conditions”*

It is widely reported across varying publications that deals completed during an economic downturn are quite often the most successful, with such conditions creating opportunities for buyers to achieve better returns.**

So, if the mergers and acquisitions market remains competitive for 2023, we ask ourselves “What sectors are attractive to investors, and how can business owners make their companies attractive to investors to enable a successful exit?”

* Succeeding through M&A in uncertain economic times: PwC

** Global M&A Industry Trends Outlook: PwC

Multiples Achieved

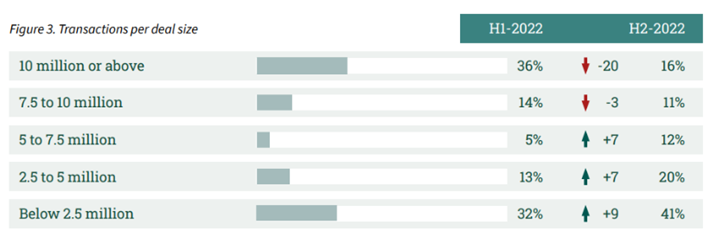

The latest M&A monitor produced by Dealsuite.com, which looks at data trends in the UK & Ireland mid-market sectors, noted an “increase in transactions with a deal size below 2.5 million” with “54% of advisors reporting an increase in assignments”.*

*Dealsuite, M&A Monitor February 2023 Edition 6

Source: Dealsuite, M&A Monitor February 2023 Edition 6

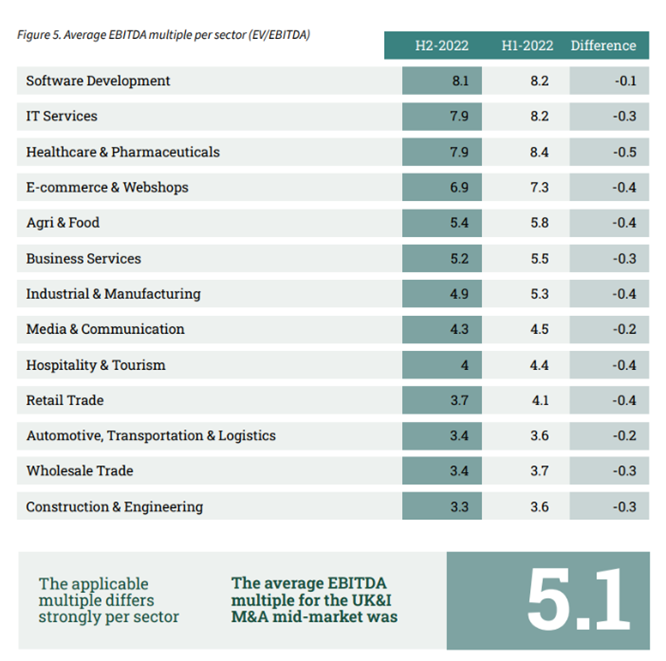

The same report tells us that the average EBITDA (profit) valuation multiple for the quarter to February 2023 was 5.1 ranging from 3.3 for Construction and Engineering to 8.1 for Software Development.

Source: Dealsuite, M&A Monitor February 2023 Edition 6

Whilst sector-wide EBITDA multiples are a helpful tool in identifying trends across the industry as a whole, it is well worth noting that within this data are companies of varying sizes which heavily influence the average EBITDA multiple. As is the same against any economic background, the fundamental strength of each individual company will have a major impact on the EBITDA multiple achieved in any deal.

How can I make my company attractive to funders and buyers?

This leads nicely to the importance of general housekeeping for business owners. For transactions to be realised, specifically against a backdrop of greater uncertainty, it’s more important than ever to revisit best practices.

At Shorts, we offer a ‘Transaction Readiness’ service which involves a detailed analysis of a Company’s current housekeeping; areas of concern, weaknesses and points for improvement. Such a detailed examination of a company’s current performance helps to maximise value when marketing a company for sale.

We focus on a range of key areas when performing this project for a client. These would involve, but would not be limited to, issues surrounding strategy, financial performance (both historic, current, and forecast), operations, employees, capital, and leadership. Investing in understanding what your business is doing well and what changes would make your business more attractive to potential purchases is of vital importance in maximising value.

How easily will buyers fund acquisitions?

What drives transactions and enables them to happen is the availability of funding, whether this is cash on a company’s balance sheet, private equity or borrowing.

Capital in the form of public equity, borrowing or private capital, all play a role in helping companies acquire others. The availability of these funds is forecast to remain strong throughout 2023 despite predicted interest rate rises across different global markets.

As a report by PwC noted, “the amount of funding available for deals is larger and more diverse than ever”* with a substantial “amount and diversity of capital available for M&A”**. Debt markets in particular have changed and expanded greatly over recent years with many funds issued by some providers having fewer covenants and more flexibility than those from high street banks.

Whilst the availability of traditional debt funding from high street banks for M&A activity tends to decline in a downturn- during this time private capital often flourishes**. As noted in PwC’s report, whilst traditional bank lending into deals has fallen as part of overall M&A activity, the increase of private debt funds, venture capital (VC) and private equity (PE) has increased the volume and mix of capital.”**

Here at Shorts, our large Corporate Finance Team are part of an expansive network of connections within the debt and equity markets. We pride ourselves on being at the forefront of knowledge in relation to the latest offerings and investment criteria of regional and national debt and equity fund providers. Over many years working together on transactions of various sizes, we have built a solid reputation within the industry of good quality deal opportunities.

*Succeeding through M&A in uncertain economic times: PwC

**Preparing for successful M&A in uncertain economic times: PwC

Get in touch with the Shorts team

If you’ve been thinking about selling your business but have been worried about doing so in the current economic environment, we hope this blog has provided you with some assurance that the market is still very much an active place for M&A activity. The funding market, which often enables deals to be completed, is competitive and diverse, allowing deals of a wide variety of sizes to be completed.

If you want more information on how we at Shorts can help you sell your business, or if you are interested in ways in which we can help get your business sale ready, please don’t hesitate to get in touch. Our friendly, approachable team are here and happy to help.2

|

Try our free Business Valuation Calculator

For business owners, the current value of your business is vital information – particularly in helping you decide if it is time to consider your exit planning options. Use our free business valuation calculator to gain a rough idea of what your business may be worth. |

Adam Ames

During my career, I have gained an experience and an appreciation of the many issues and opportunities faced by businesses during all market conditions and economic cycles, which I use to provide invaluable advice to clients across all areas of corporate finance including EOTs, MBOs, acquisitions, disposals and finance raising assignments.

View my articlesTags: Corporate Finance