Christmas is approaching, and the Shorts tax team is getting into the festive spirit.

T’is the season of sharing, and the Shorts Tax team is always eager to help everyone manage their tax position better – whether they are clients or not! So, without further ado, here are this year’s 12 Tax-saving tips of Christmas 2024.

1. Optimise your company/group structure

As businesses grow, they will often have several different activities within one entity or establish separate companies for each activity. Both of these can be inefficient. A careful review of this can help identify the most tax-efficient structure for shareholders. Two key alternatives here include:

- A group structure with a holding company owning subsidiaries, which provides legal separation while retaining tax benefits.

- Shareholders directly holding individual companies instead of using a holding company, which can be more tax-efficient if a company is sold.

2. Pay a lower rate of Corporation Tax through the Patent Box regime

Patent Box Relief rewards UK companies that are innovating with patented inventions. Companies generating income from patented products may qualify for a 10% Corporation Tax rate on profits from those patents, a 60% reduction from the standard rate.

3. Sell your company to an Employee Ownership Trust (EOT)

Shareholders may sell their shares to an Employee Ownership Trust (EOT) instead of pursuing a Management Buyout (MBO), Management Buy-In (MBI), or Company Purchase of Own Shares (CPOS). Selling over 50% to an EOT can benefit from low Capital Gains Tax rates under the right conditions. As a longer-term Christmas present, the EOT means that the company must be run for the benefit of all employees and can award annual tax-free bonuses of up to £3,600.

4. Optimise salary and dividends

Traditionally, shareholder-directors benefitted more from a small salary and maximising dividends instead of primarily a salary. However, changes in rates in recent years could alter this conclusion, particularly where they have other income. Various factors must be considered, so it's advisable to seek guidance.

5. Consider the benefits of a holding company

A holding company is a parent entity that owns a controlling interest in one or more subsidiaries. It typically doesn’t engage in trading; its main purpose is to form a corporate group. Benefits of a holding company structure include:

- Protecting key assets from risks in other subsidiaries.

- Enabling tax-free sales of subsidiaries through substantial shareholding exemptions.

- Centralising resource management and shared costs.

6. Companies holding lots of cash should consider separation

Tax legislation favours shares in trading companies over investment ones. Shares in companies with excess cash may not qualify for Business Asset Disposal Relief (BADR), which offers a lower CGT rate on sales, or Business Property Relief (BPR), exempting the value of shares in trading companies from IHT (this exemption may decrease in April 2026), especially if the cash is used for making investments. Hence, separating investment and trading activities can help maintain these reliefs.

Techniques include demergers or share changes to transfer excess cash to separate investment companies. This can protect assets, and create funds for new business ventures or family wealth planning.

7. Make sure you’re getting VAT right

Getting VAT wrong is common. We help clients by conducting a mock HMRC VAT visit to ensure compliance. Identifying VAT issues now can prevent major future problems, especially if the business faces a real HMRC VAT visit, where cumulative errors might be significant.

8. Make sure you get the right workers on the payroll

HMRC scrutinises businesses that frequently use subcontractors, and can claim they should be classified as employees. Potential penalties in these cases can be significant. We can conduct tests to assess compliance and identify issues early to reduce HMRC challenges.

9. Employee reward packages

Employee incentives like bonuses, non-cash benefits, and pension contributions effectively reward staff. Some options are more tax-efficient, leading to better retention of key employees. Tax-free benefits, including mobile phones, childcare vouchers, and pension salary exchange, can motivate staff.

Additionally, 'trivial benefits' such as non-cash vouchers under £50 can be provided tax-free, as long as they aren't for service performance.

10. Tax-efficient cash extraction for business owners

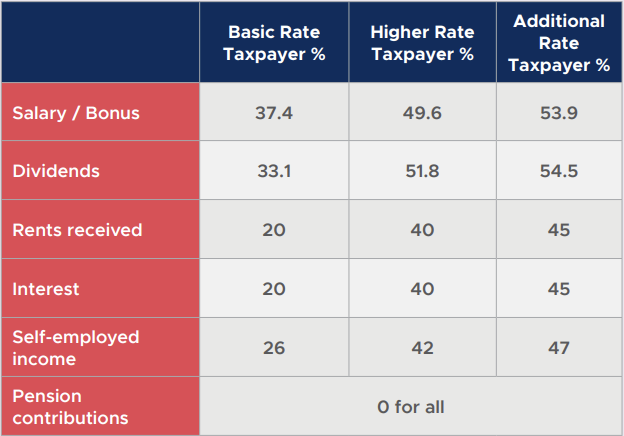

With combined Income Tax and National Insurance rates of up to 47%, business owners should regularly assess the most tax-efficient remuneration methods. Options include salary, dividends, benefits, rent, interest, and pension contributions, each with varying tax rates as shown below.*

Conduct a review to determine the most tax-efficient mix of these income sources, as tax rates vary annually.

*The above rates are illustrative only, applicable from April 2026, and can change dependent on individual circumstances so shouldn’t be relied on without bespoke advice being sought.

11. Use trusts to protect assets and save Inheritance Tax (IHT)

Assets can be transferred to a trust to remove them from the estate for Inheritance Tax (IHT) purposes of the person transferring the assets. The trust is a separate legal entity that is overseen by trustees who effectively act as the management board of the trust.

Although the legal ownership of the assets is transferred to the trustees, the person transferring them can firmly stipulate what the assets can and cannot be used for in future, even after they have died. Trusts are therefore a very useful way of disposing of legal ownership whilst maintaining a degree of control over the assets in future.

There is often merit in establishing a trust on the death of a parent. Trusts can be used to ensure that children receive the benefits of any inheritance under the supervision of trustees appointed by their parents. This can help to protect family assets if children get divorced, and can also prevent them getting too much money at an early age.

12. Have the right succession plan in place for a family business

Family businesses can run the risk of not being sustainable unless the owners have a succession strategy. This can include passing the business on to family members, the management team, a third party or an EOT. We can assist business owners with this, helping to explore which options are best suited to the family and the business.

For more tax-saving tips, download the Shorts Tax Saving Guide

These 12 tips have been taken from the Shorts Tax Saving Guide, a free resource, whether you are an existing client or not. For more tax-saving tips like this, we encourage you to download the guide today.

Written for entrepreneurs and small to medium sized businesses, this free guide is full of useful tax planning ideas, as well as important tax risks to avoid.

The Shorts Tax Saving Guide is available in both web and printable PDF versions, including an additional tax planning checklist and notes page.

.jpg)

Brian Gooch

I work extensively in the corporate owner managed business sector, covering transactional taxes, property taxes including Stamp Duty Land Tax and VAT, and all areas of business tax planning. I have considerable experience in maximising tax efficiency by reviewing business structures and planning corporate reorganisations.

View my articles