Is it unfair to claw back Child Benefit? As we are now almost at the self assessment deadline, one of the conversations our personal tax managers have regularly been having with clients, is regarding the government’s claw back of child benefit from what are deemed to be higher earning families.

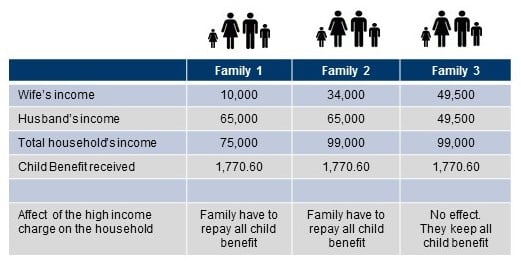

The current rules appear to contain an inherent unfairness that results in some taxpayers escaping the charge, whilst others who have a similar or much lower overall family income paying the charge in full. The charge arises where an individual or their partner claims the Child Benefit for a child that is living with the individual, and one of the parties has income that exceeds £50,000.

A tax charge is calculated as an appropriate percentage of the Child Benefit received and has the effect that, once the higher earner’s income exceeds £60,000, all the Child Benefit received is clawed-back from the higher earner. To avoid the charge it is possible for the person claiming the Child Benefit to stop receiving it.

The unfairness arises where a couple are in a position to adjust their income such that both parties receive less than £50,000 per year, or where one party earns a relatively low amount, yet the other earns above £60,000.

By the operation of Section 681C of ITEPS 2003 Family 1 and 2 will have a full claw-back of the Child Benefit as the high earning partner’s income is £60,000. However, Family 3 will avoid the High Income Child Benefit Charge because neither of their income exceeds the £50,000 limit set out in Section 681B(1) of the Act. This is despite the fact that they have identical overall income to that of Family 2.

We have made representations to the treasury to correct this imbalance, but, if you are affected by this tax charge talk to us to see is there is any way to help avoid paying the charge.