If you are a VAT-registered aesthetic clinic, are you charging VAT on all your treatments?

HMRC have generally insisted that all treatments provided by aesthetic clinics are for cosmetic purposes and are subject to VAT at the standard rate. This is based primarily on HMRC relying on a clinic’s website for information without considering that a website is aimed at attracting customers interested in cosmetic surgery.

In some cases, customers requiring aesthetic treatment for medical conditions are referred to aesthetic clinics by GPs or other health professionals.

VAT on cosmetic surgery

Aesthetic surgery which is not carried out for “medical treatment” purposes is subject to VAT at the standard rate of 20%.

In this instance, aesthetic surgery is often described as cosmetic surgery and is defined as a service that clients seek principally for cosmetic reasons, even if it provides health benefits such as improved mental well-being.

HMRC will typically only consider a cosmetic surgery procedure as medical treatment if the principal purpose of the procedure is to “maintain or restore good health”, such as reconstructive plastic surgery.

This is a grey area, so seeking the right advice on your VAT treatment is essential to ensure you aren’t missing out on VAT opportunities.

VAT refunds for medical treatment

HMRC are happy for aesthetic clinics to charge VAT on all their services but, when challenged, does not accept that some services are medical treatment (which means they would be exempt from VAT).

Specifically, HMRC accepts that medical services are being provided if a clinic is CQC registered and treatments are offered for conditions such as migraine, hyperhidrosis, alopecia and scarring.

So, if you are VAT and CQC registered and are not taking advantage of VAT exemption for medical treatment, you may be able to make a claim to HMRC for overpaid VAT.

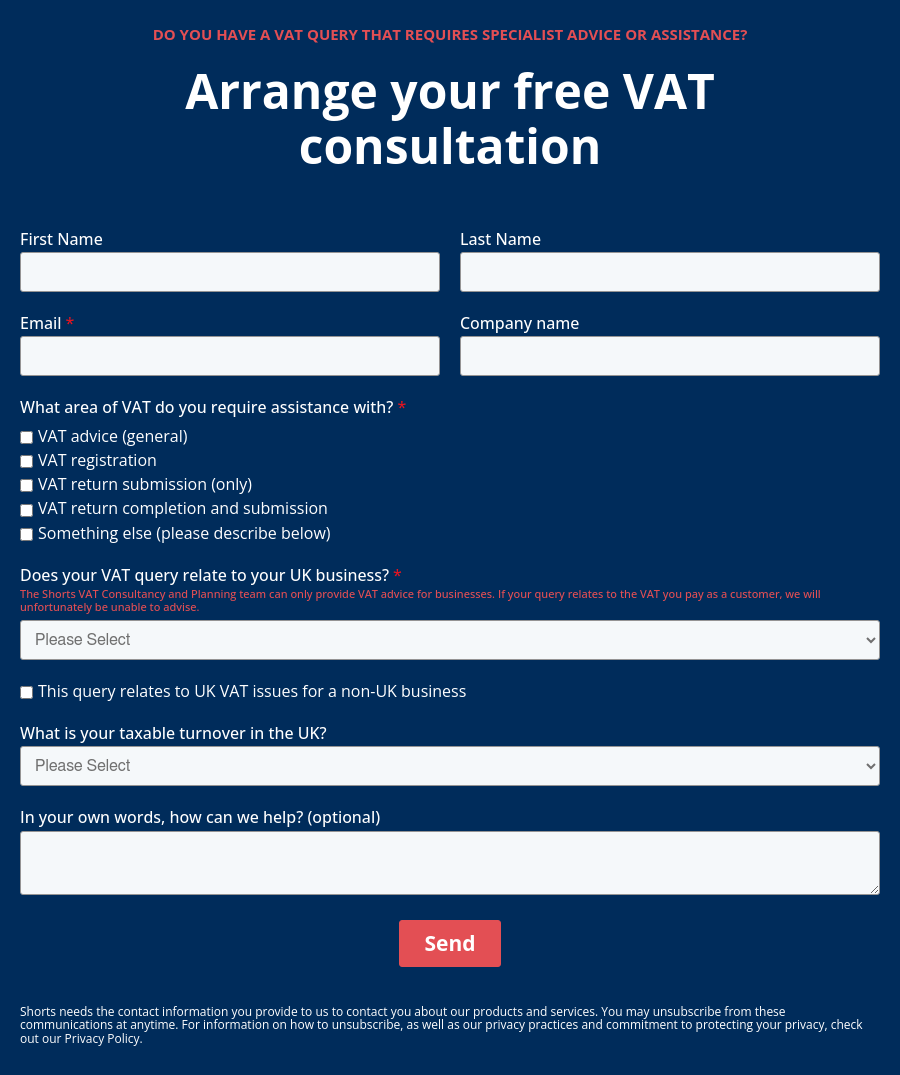

How Shorts can help

The Shorts VAT team has successfully obtained VAT refunds for aesthetic clinics, even when HMRC initially took issue with the claim.

Our team calculates and submits the claims on your behalf and deals with any follow-up questions from HMRC on a no-win, no-fee basis; so, if your claim is unsuccessful, you are not charged for our work.

If you think you may be due a VAT refund on this basis, we encourage you to contact our team today.

Lynne Gill

My area of expertise is land and property transactions but I have extensive knowledge of both domestic and international VAT and I love complex VAT queries. I have an Honours degree in Business Studies and a VAT legal and technical qualification from the Institute of Indirect Taxation.

View my articlesTags: VAT