A group company structure is a business model in which a parent company, often referred to as a holding company, owns and controls a number of subsidiary companies.

A subsidiary is an independent legal entity that is owned and controlled by another company, known as the parent company. Subsidiaries often have their own management and operational teams, allowing them to function autonomously. However, the ultimate control and ownership of the subsidiary lie with the parent company, which may influence or make decisions for the subsidiary as part of its overall business strategy.

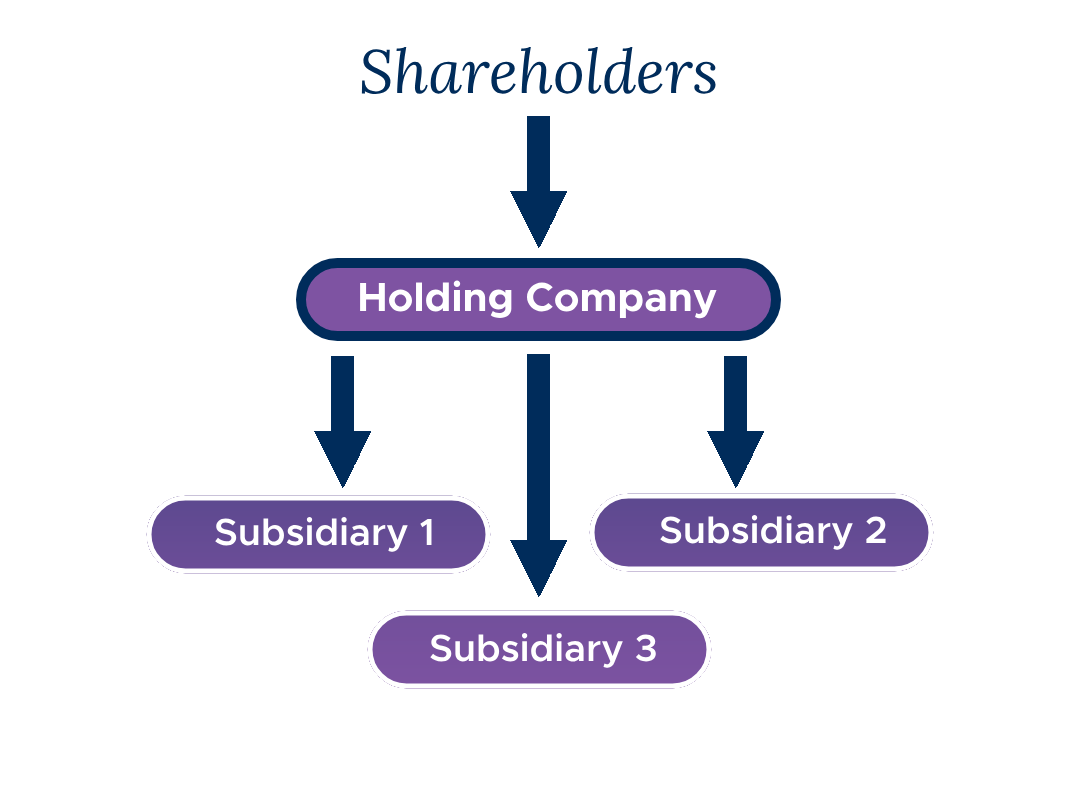

Example of group company structure

Below is an example of a simple group company structure, featuring the shareholders, holding company, and how it acts as a parent to various subsidiary companies. A real group company structure may be considerably more complicated than the below, which serves as an illustrative example.

Advantages of a group company structure

A group company structure may be a good idea for a few reasons, depending on the specific circumstances and needs of the business.

- Diversification: A group company structure can enable a business to diversify operations and move into different industries or geographic locations, utilising a new subsidiary company for each activity. This can help reduce risk to the parent company.

- Centralised control: A parent company can exercise centralised control and oversight over its subsidiaries. This can help ensure consistency in operations, branding, and other important aspects.

- Access to resources: Each subsidiary within a group company structure can benefit from shared resources and expertise, such as finance, marketing and advertising, research and development, and supply chain.

- Tax benefits: A group company structure may provide tax benefits, such as the ability to offset losses in one subsidiary against profits in another.

- Financing advantages: A group company structure can enable better access to finance. A lender might look more favourably upon a larger, more diversified business with a strong record of performance.

A group company structure may not always be the right option

Despite the benefits listed above, a group company structure is not always the best option.

- Smaller businesses, or those that operate in a single specific industry, may see little benefit from a group structure. These companies may find that the increased complexity and administrative burden of managing multiple legal entities outweigh the potential advantages.

- The costs associated with setting up and maintaining a group structure—such as legal fees, accounting expenses, and additional compliance requirements—can be prohibitive and divert valuable resources away from core business activities.

- Smaller businesses may not require the same level of diversification or centralised control that larger conglomerates benefit from, making the group structure an unnecessary complication. I

In many cases, a simpler organisational structure may be more efficient and conducive to agile decision-making, allowing smaller companies to remain focused in their market.

Examples of real life group company structures

- The Tata Group is a multinational conglomerate based in India that operates in over 100 countries. The group consists of more than 100 companies, including Tata Motors, Tata Steel, and Tata Consultancy Services. The group is owned by Tata Sons, which serves as the holding company and oversees the operations of each subsidiary.

- Unilever is a multinational consumer goods company with operations in the UK and overseas. The group is made up of a parent company called Unilever PLC, and subsidiaries like Unilever UK.

- Procter & Gamble is an American multinational company selling various consumer goods. The group manages multiple brands through subsidiaries, which protects the parent company from liabilities associated with separate products.

How do you set up a group company structure?

-

Determine the business objectives: What do you want to achieve through the structure, and is the structure the best solution?

-

Set up a holding company: The holding company will own or control the subsidiary companies. This may be an existing company or set up for the purpose of the group structure.

-

Establish subsidiary companies: These should be separate legal entities with their own operations and management

-

Determine the ownership structure: This will determine how much control the holding company has over the subsidiary companies.

-

Create a governance framework: This outlines the roles and responsibilities of the holding company and each subsidiary.

-

Consider tax and legal implications: Ensure that the structure is set up in a way that maximises benefits and minimises risks.

-

Implement and monitor the structure: This might involve regular reporting and review of the subsidiary companies' operations and financial performance, as well as making adjustments to the structure as needed to ensure that it continues to meet the business objectives.

There is a lot to manage and consider when setting up a group company structure. They can be complex and may involve multiple legal entities. For this reason, we suggest seeking professional assistance from a qualified accountant and legal expert to ensure the group structure is legally compliant and optimised for your business objectives.

Group Company Structure FAQs

What are the different types of group company structures?

- Holding company structure: The most common type, with the holding company directly owning a majority of shares in subsidiaries.

- Management company structure: The parent company controls subsidiaries through management agreements without necessarily owning a controlling stake.

- Joint venture structure: Two or more companies establish a separate company for a specific project, sharing ownership and control.

What are the potential drawbacks of a group company structure?

- Increased complexity: Managing multiple companies can be more complex and require additional administrative work.

- Higher costs: Setting up and maintaining a group structure may involve higher accounting and legal fees.

- Potential for bureaucracy: Multiple layers of management can lead to slower decision-making.

Who would benefit from a group company structure?

Companies seeking asset protection, managing growth through acquisitions (adding subsidiaries), or centralising functions like finance or human resources, may benefit from a group company structure.

Is a group company structure suitable for all businesses?

No. Businesses should consider their size, risk profile, and future growth plans before deciding. This structure is typically more relevant for larger or fast-growing companies.

What are the reporting requirements for a group company structure?

Group companies are typically required to prepare consolidated financial statements that present the financial position and performance of the entire group as a single economic entity.

What legal and regulatory considerations are there?

The legal and regulatory framework for group structures can vary depending on the jurisdiction. Seeking professional legal advice is crucial during the setup and ongoing operation.

When should I consider seeking professional advice?

Consulting with a qualified accountant and lawyer is highly recommended before implementing a group company structure. They can help you assess the suitability for your business, navigate the legal and regulatory landscape, and ensure proper implementation.

David Robinson

As a Tax Partner, I advise clients on all aspects of UK tax, ranging from business taxes, transactions and private client matters, helping to achieve the objectives and aspirations of businesses and their owners.

View my articlesTags: Holding Company