Xero has recently announced a new feature allowing business and accountancy users to use open banking to pay bills directly from their Xero log-in.

This welcome addition to a platform already stacked with useful features will help users manage their cash flow with greater speed, efficiency, and security.

It eliminates the need to toggle between multiple platforms. Users can pay bills directly within the Xero interface with a few clicks, saving valuable time and reducing the risk of errors associated with manual data entry.

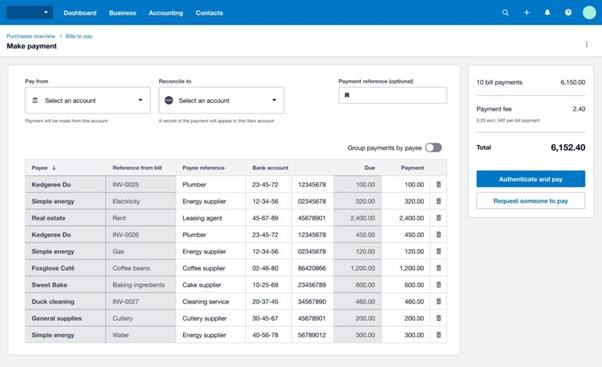

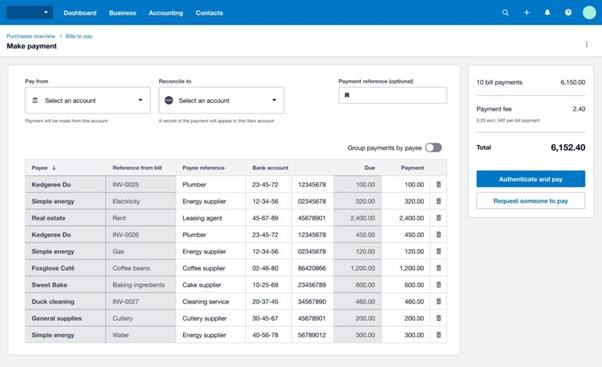

How paying bills from Xero works

The new feature is as easy to use as you would expect from Xero and involves selecting which bills you need to pay, issuing a payment request, and then authorising them directly from Xero.

Image from Xero

Image from Xero

How to set up the new Xero Bill Payments Experience

The new feature can be set up and used for existing Xero users with the following steps:

- First, you must connect your bank to your Xero account if you haven’t already. It’s important to note that your UK bank must support bulk payments via open banking for this to work.

- From the “Bills to pay” screen, you can select “Direct bank transfer” as a payment method. This can be used to pay the bills in GBP, whether one at a time or in bulk.

- Multi-factor authentication will be needed to authorise the payments (from your banking app or other online portal).

More information about the new bill payment experience can be found on the Xero blog.

What is open banking?

This feature is enabled by open banking. But what is that exactly?

Open banking is a system that allows businesses to securely share financial information with third-party providers through application programming interfaces (APIs). It represents a significant shift in how customers access and manage financial services.

Open banking brings some considerable benefits to business finances:

- Unified financial view – all financial accounts in one place

- Greater control over data and information and who accesses it

- Simplified transactions – you can initiate payments or transfers to multiple places from a single platform

- Faster and more efficient services – no need to pay each bill separately

- Better user experience – no need to navigate several varying platforms to keep on top of things

Not with Xero yet? We can help

Regarding managing accounts, payroll, and related business responsibilities, we think Xero offers the most flexible and useful accounting platform for small and large businesses.

Xero is a user-friendly interface and, thanks to being cloud-based, is accessible anytime and anywhere. We believe it is the ideal software partner for any business, particularly if they lack the time or resources to manage their accounts.

If you need guidance or support in starting with Xero, we'll be with you from the planning stages to delivery and training. We're here to offer continuous support throughout and even after your Xero project is complete.

|

-1.jpg)