HMRC publishes regular statistical updates on the R&D Tax Credit scheme in the UK. The latest findings for September 2023 have now been published, with some significant statistics to note.

R&D Tax Relief stats – the big picture

- A total of £7.6billion in R&D tax relief support was claimed for the tax year 2021/22. This is a year-on-year growth of 11%.

- Total R&D expenditure for this period topped out at £44.1billion, an 8% jump from the previous year.

- HMRC estimates that 90,315 R&D tax credit claims were submitted in 2021/22, a year-on-year growth of 5%.

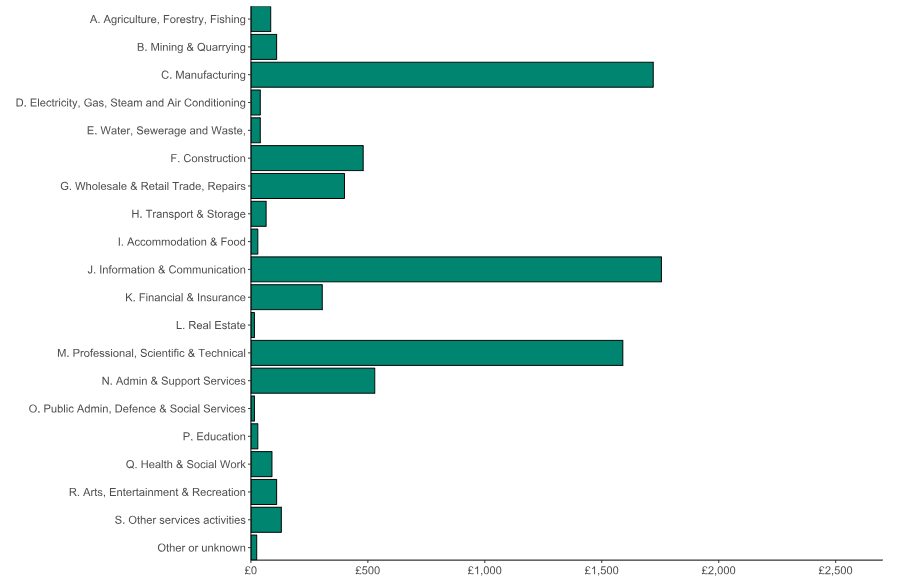

- 62% of total claims for 2021/22 were by companies operating in the UK's Information & Comms, Manufacturing, and Professional, Scientific and Technical sectors. This made up 67% of the total amount claimed through the scheme.

The full report on gov.uk and includes details on the number of claims, the amount of relief claimed, regional and industry analyses, cost-band analysis, and first-time application data. Below are some selected highlights.

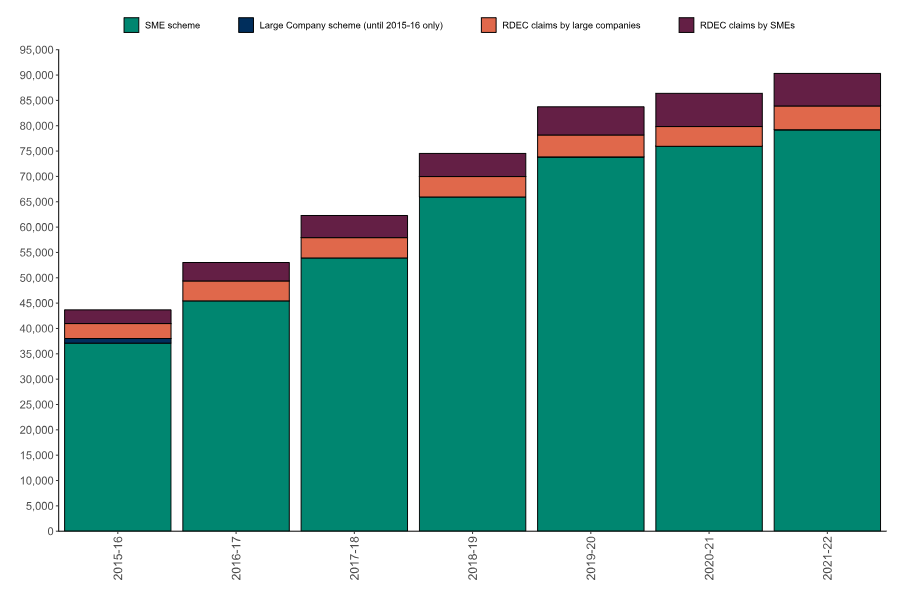

The SME scheme continues to dominate

The Small or Medium-sized Enterprise (SME) scheme is by far the most widely used of the R&D schemes available, with 79,205 of the 90,315 total claims. Just over 11,000 RDEC scheme claims were also made.

Image source: Research and Development Tax Credits Statistics: September 2023 - GOV.UK (www.gov.uk)

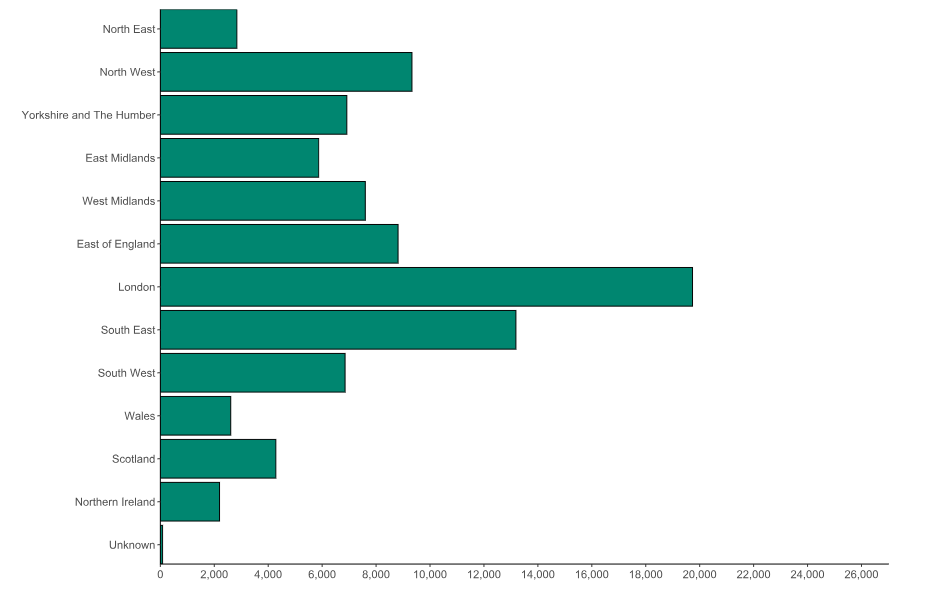

London sees more claims than any other region.

HMRC’s regional analysis showed that London, followed by the South East, are the regions with the greatest number of R&D tax credit claims, corresponding to the most significant amount of relief claimed.

Yorkshire and the Humber was the fifth busiest region of the UK in terms of total R&D tax credit claims.

Image source: Research and Development Tax Credits Statistics: September 2023 - GOV.UK (www.gov.uk)

Greater emphasis on errors and fraud

Errors and fraud are major talking points surrounding the R&D tax relief scheme, and HMRC is continuing to place greater emphasis on identifying and tackling these issues.

According to the government’s Audit Report and Accounts 2022/23 document, they estimate that:

“the overall level of error and fraud for both schemes for 2020 to 2021 is 16.7% (£1.13 billion), higher than the previously published estimate of 3.6% (£336 million) for 2020 to 2021.”

Of the two schemes, the SME scheme is more problematic in this regard. As reported by HMRC:

“The level of error and fraud in 2020 to 2021 is 24.4% (£1.04 billion) for the SME scheme and 3.6% (£90 million) for the RDEC (Research and Development Expenditure Credit) scheme

Manufacturing, ICT, and Professional, Scientific and Tech dominate claims

Manufacturing, Information & Communication, and Professional, Scientific, & Technical were the busiest industry sectors for R&D tax credit claims in 2021/22. These sectors saw the highest volume of claims submitted and most of the R&D tax credits issued.

Other sectors that engaged heavily with the scheme last year include Construction, Wholesale & Retail Trade, Repairs, and Construction and Admin & Support Services.

Image source: Research and Development Tax Credits Statistics: September 2023 - GOV.UK (www.gov.uk)

Darryl Hoy

Darryl is the Technical Director of the Radius team. He is a specialist in Research & Development tax reliefs, having previously worked at HMRC as an R&D Tax Inspector.

View my articles