We regularly advise clients on of the benefits of creating a group structure via the use of a holding company. But what exactly does this mean? And what are the key advantages and disadvantages to creating one?

What is a Holding Company?

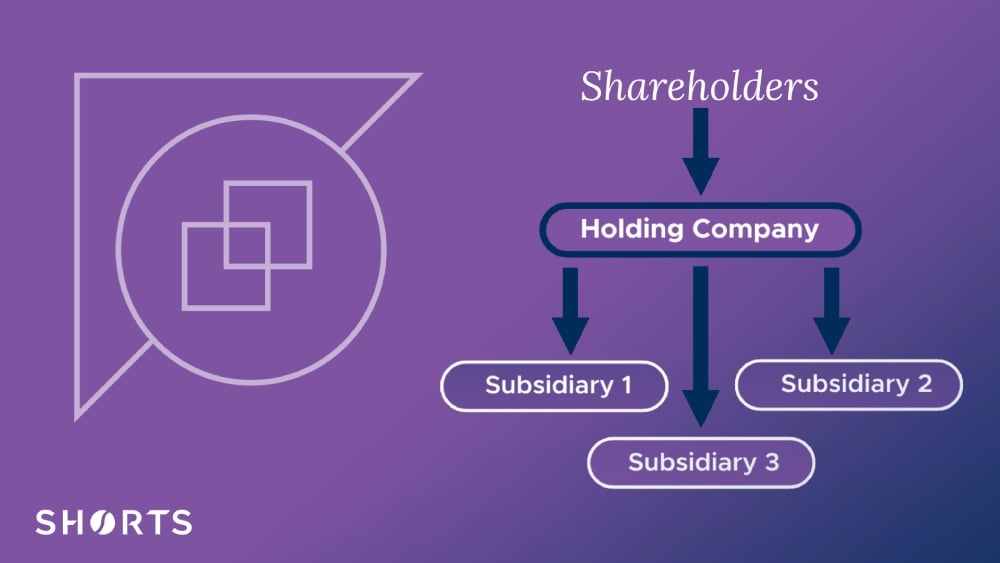

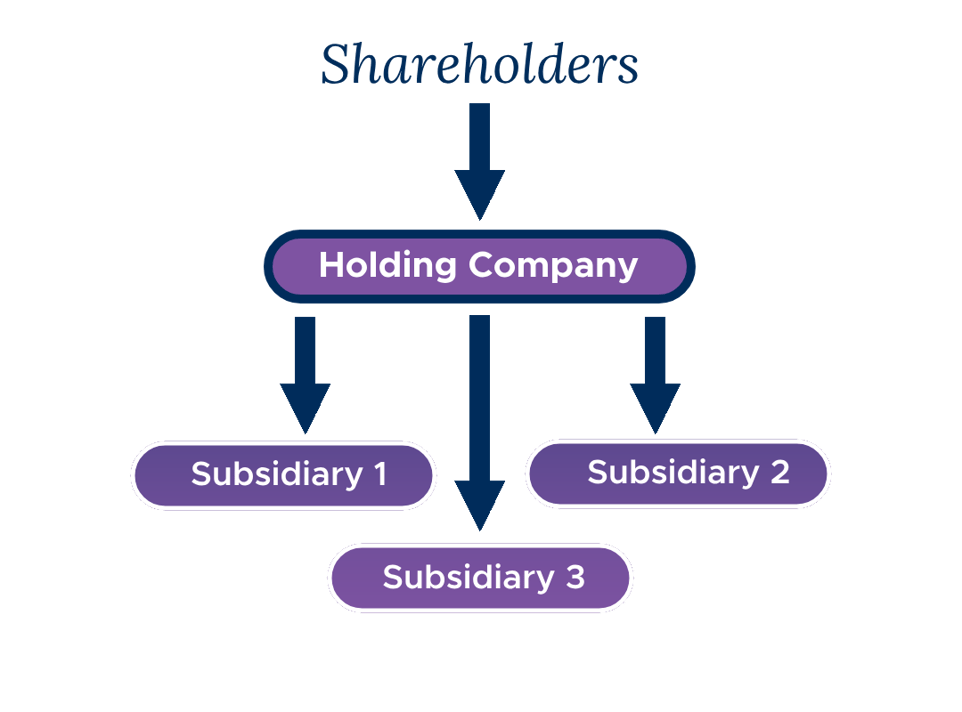

A holding company is a separate parent company created to own a controlling interest in subsidiary companies. A holding company doesn’t trade itself; its main purpose is to form a corporate group.

An example of a typical corporate group structure is below:

Video: how does a holding company work?

What is a holding company used for?

Holding companies are often used as a way to provide a level of protection for the assets of the subsidiary companies. The subsidiaries can operate in different industries or markets, and the holding company can provide support and other resources.

Here are the reasons why a holding company in a group structure is more beneficial than a standalone company.

1. Reduce risk

One of the main benefits is risk management. If a company undertakes multiple trades, or has separate investments such as property, stripping these out into separate subsidiary companies under the common control of a holding company may be worthwhile.

A group structure minimises the risk to the trade of the subsidiaries if one part of the group underperformed or become insolvent. This would not be the case if everything operated within a single company.

2. Asset protection

A holding company can hold the valuable assets of a business. This includes trading or investment property, plant and machinery, intellectual property and excess cash for investments. Subsidiaries take on the daily operations of the business and its trading responsibilities.

Assets may be leased to the subsidiaries if required, but are protected from creditors and the inherent risks of trading.

3. Tax benefits

Dividends can pass between subsidiary and holding company without incurring tax charges. Where a company owns more than 10% of the shares in another company and sells those shares, there is usually no tax to pay on any gains.

4. Shared costs

Admin and central services functions can be utilised by different businesses. They can sit beneath a holding company, which makes charges to the subsidiaries. This means the costs can be shared appropriately amongst them.

How is a holding company inserted?

The Holding Company is usually inserted above a current company, as the ultimate parent of a group of companies.

The current Shareholders exchange their shares in the current company for shares in the Holding Company. If done correctly, this can normally be achieved tax-free, but does require careful consideration and communication with HMRC, to ensure that the exchange is not subject to tax.

Following the insertion of the Holding Company, the Shareholders now hold shares in the Holding Company, as opposed to the trading company.

There are a number of tax implications of inserting a Holding Company which need to be analysed, as failing to structure the insertion of the Holding Company correctly can have serious tax consequences, and potentially lead to Capital Gains Tax, Income Tax, Stamp Duty, and Inheritance Tax implications.

Do holding companies pay tax?

In some cases, holding companies may also be used for tax planning and management, as the tax liability of the holding company and its subsidiaries can be managed in a more efficient manner.

Generally, a holding company does not trade as its sole purpose is to hold the assets of the group. Income may be generated from leasing these assets to the subsidiary companies.

Dividends paid from subsidiaries to the holding company are not taxed on the basis that both companies are UK resident.

How do you remunerate owners of a holding company?

The owners of a holding company extract surplus cash from the holding company as dividends. This is like the shareholders of any limited company,

Dividends will be taxed if the income exceeds a dividend allowance (which is currently £500 as of April 2024). The rate of tax depends upon the income tax band of the shareholder.

| 2024-25 | |||

| Band of taxable income | Rate | Rate if dividends | |

| £ | % | % | |

| 0 – 37,700 | Basic rate | 20 | 8.75 |

| 37,701 – 125,140 | Higher rate | 40 | 33.75 |

| Over 125,140 | Additional rate | 45 | 39.35 |

Can a holding company buy other companies?

There are several benefits of bringing companies together under a Holding Company structure. But the Holding Company can purchase other companies.

The Holding Company sits at the top of a group structure, with any company purchased becoming a subsidiary.

This can be useful when a business is on an acquisition trail, but wishes to retain the acquired business in a separate group company. This additional subsidiary can then ring fence assets by transferring them up to the Holding Company.

Using a Holding Company and group structure can preserve important reliefs. It allows assets to be transferred around the group, and prepares subsidiaries in advance of selling an asset or trade within the group.

Examples of famous holding companies

Here are some examples of famous holding companies in the UK and around the world:

- Tesco plc

- Unilever plc

- GlaxoSmithKline plc

- BP plc

- Berkshire Hathaway

- Alphabet Inc.

Want to understand the benefits of a Holding Company?

It is important to obtain advice to avoid any surprise tax charges when considering a holding company.

Shorts's Business Tax team can help you plan the transactions necessary to change the structure. We will also contact HMRC to obtain the necessary clearances. We will also ensure you are taking advantage of the tax exemptions and reliefs available.

David Robinson

As a Tax Partner, I advise clients on all aspects of UK tax, ranging from business taxes, transactions and private client matters, helping to achieve the objectives and aspirations of businesses and their owners.

View my articlesTags: Business Taxes, Holding Company