The VAT rules for overseas sellers selling goods to UK customers may be complex, but they’re essential to understanding what obligations HMRC expects you to fulfil. Learn what consignment values, goods imports, sales channels and other criteria can impact your VAT compliance as an overseas seller in the UK market.

Background on VAT rules for overseas sellers

Since 1 January 2021, an overseas seller will have to charge UK “output VAT” at the point of sale instead of being liable to import VAT if two conditions are met:

-

The consignment of goods have a value of £135 or less.

-

The consignment is located outside the UK and sold directly to customers in Great Britain (England, Scotland and Wales).

If goods are imported, into the UK, and do not meet these conditions, depending on the transaction, then an overseas seller may be liable for import VAT and customs duties.

How does HMRC define an “overseas seller”?

HMRC defines an overseas seller as someone who sells goods that are already in the UK, to UK customers, but does not have a business establishment in the UK. You are also considered an overseas seller if:

-

You are based outside the UK and sell goods to customers in England, Wales, or Scotland, then import those goods into Great Britain.

-

You are based outside Northern Ireland and the EU, sell goods to customers in Northern Ireland, and then import those goods into Northern Ireland.

From there, VAT requirements for overseas sellers vary depending on whether sales are made through an online marketplace, and whether the goods were already in the UK at the point of sale.

If goods are already in the UK at the point of sale

VAT requirements vary depending on the method used to sell the items by the overseas seller:

VAT conditions for online marketplaces

If the items are sold via an online marketplace, an overseas seller has a number of VAT obligations which must be met:

- UK VAT registration is required.

-

There is a deemed sale from the overseas seller to the marketplace at a zero rate of VAT.

-

The online marketplace is responsible for charging VAT to customers at the point of sale and remitting it to HMRC.

-

The seller remains liable for the VAT where the goods are for a business customer who gives them their UK VAT registration number.

-

The overseas seller is liable to any import VAT and customs duty when the goods are first imported into the UK. They can recover the import VAT though by submitting a VAT return.

VAT requirements for other selling methods

- If the sale is made through a UK business establishment, normal UK VAT registration rules apply. In this case, VAT registration is required if taxable supplies exceed £90,000 in the previous consecutive 12 months or are expected to exceed £90,000 in the next 30 days.

-

Where the sale is not made through a UK business establishment, the overseas seller must register for VAT upon the first UK sale. The seller must charge VAT and account for UK VAT.

If goods are outside the UK at the point of sale

If the goods are sold through a digital marketplace, then an overseas seller must comply with these VAT obligations:

VAT requirements for e-commerce websites

If the total consignment value is £135 or less:

-

The online marketplace is liable to charge and account for the UK VAT.

-

For business-to-business (B2B) sales, VAT is not charged by the online marketplace if the purchaser provides their VAT registration number. Instead, the purchaser accounts for VAT using the reverse charge procedure.

If the consignment value is greater than £135:

-

The overseas seller must register for VAT in the UK.

-

There is a deemed supply to the online marketplace at a zero rate of VAT.

-

The online marketplace charges UK VAT.

-

The purchaser typically pays import VAT (collected by the courier), but the seller may also be responsible for import VAT. This can be recovered on a UK VAT return.

-

For B2B sales, the buyer accounts for VAT as a reverse charge and can recover import VAT.

VAT requirements for other sales methods for goods outside the UK at the point of sale

- The overseas seller must register for VAT in the UK.

- There is a deemed supply to the online marketplace at a zero rate of VAT.

- The online marketplace charges UK VAT.

- The purchaser typically pays import VAT (collected by the courier), though the seller may pay it, with the possibility of recovering it on a UK VAT return.

- For B2B sales, the buyer accounts for VAT as a reverse charge, and import VAT is recoverable by the buyer.

Find out which VAT requirements your business needs to follow

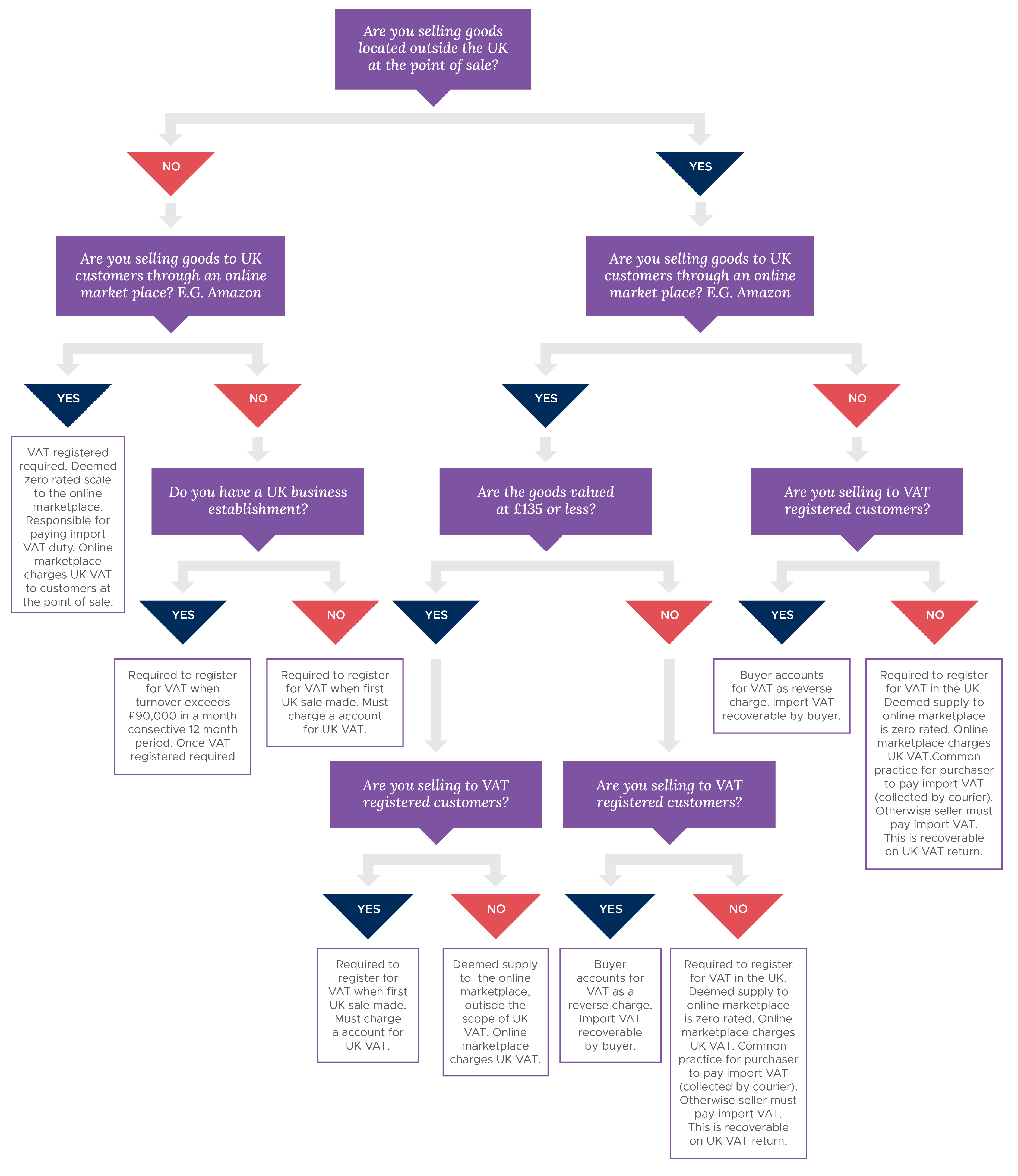

You can refer to the flow chart below to determine the next steps you should take to ensure you’re compliant with UK VAT legislation.

How do you calculate the value of a consignment?

A consignment’s value is the price of the goods, minus transport and insurance costs (unless they are accumulated into the cost of the items and not displayed separately). A seller should also exclude any identifiable taxes or charges, too.

Why a value of £135?

The low value threshold allows goods with a value of £135 to be imported into the UK without import duty being charged. This allows overseas sellers to sell goods with a value of less than £135 directly to customers without the consumer having to pay import duty to release the goods.

The value is set at £135 because this is the equivalent of 150 euros. This is currently being reviewed as the UK Government are considering abolishing this concession.

Are any goods not subject to these VAT requirements?

There are limited exemptions on UK VAT requirements for overseas sellers. In particular, these conditions do not apply to the import of:

- Non-commercial goods, such as gifts.

- As long as VAT is collected and paid to HMRC under the Import VAT Accounting Scheme, goods imported from Jersey and Guernsey will not be subject to these requirements.

What if an overseas seller isn’t compliant with UK VAT legislation?

HMRC may levy non-compliance penalties to overseas sellers that do not adhere to UK VAT requirements.

Get advice on your UK VAT requirements

VAT is one of the more complex areas of tax for businesses, especially if you’re an overseas seller. Our specialist VAT advisory department can help you navigate myriad VAT legislation and answer questions that are specific to your business’s needs.

Paschal Okonkwo

I work as a tax advisor at Shorts, helping companies and individuals stay tax compliant in the UK.

View my articles