The latest Quarterly Inflation Report (QIR) from the Bank of England has been published and shows that ‘the Old Lady’ has changed her mind a little. But the market projections for short-term interest rates don’t make for helpful reading for those with cash deposits.

The QIR was published in May, a few days before the Office for National Statistics revealed that in April, CPI inflation was running at 2.7%, 0.7% above the Bank’s target. The Bank shouldn’t have been surprised to see the higher inflation number. It’s QIR projected a short-term increase, with inflation reaching 2.8% in the final quarter of this year. Thereafter the Bank’s central projection is in for a gentle decline in the pace of price increases that will still leave inflation above target in the early part of 2020.

Why isn’t the Bank raising interest rates?

In his opening remarks when presenting the QIR, Mark Carney, the Bank’s Governor, said “The projected inflation overshoot entirely reflects the effects on import prices of the fall in sterling since late November 2015 – a depreciation caused by market expectations of a material adjustment to the UK’s medium term prospects as it leaves the EU.” This explains why the Bank is not raising interest rates, which would be its usual response to above-target inflation.

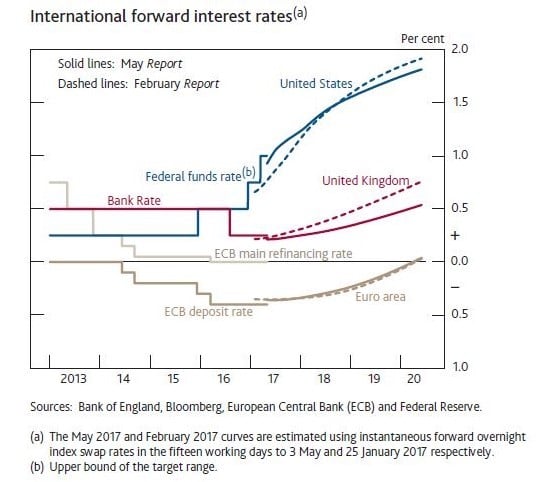

There is a highlighted page of the QIR devoted solely to explaining why global interest rates are so low and likely to continue to be. For the UK, the Bank notes that the money markets are currently projecting that short-term real (inflation-adjusted) rates will still be around 0.25% in ten years’ time, compared with an average of 2.75% between 1993 and 2007. Demographics and “heightened risk aversion” are to blame in the Bank’s view.

The current combination of sub-1% short term rates and 2%+ inflation is unwelcome news if you hold much cash on deposit: the longer your money is in the bank, the less it will buy. That may be a price worth paying if you are convinced that investment markets worldwide are headed for a fall in the near term. If you are not, or are just feeling uncertain where your money should be placed, do talk to us about the many options available.

Other useful articles:

Tags: Business Taxes